PARENTS & HOMEOWNERS: MY 7-STEP ESTATE PLANNING PROCESS WILL PROTECT YOUR HEIRS

From Creditors, Predators & Bad Choices, And Will Help You Become a (Bigger) Hero to Your Family!

Appointing Power of Attorney in California: What Families Must Know (2025)

Power of attorney is the legal shield many California families rely on to protect loved ones during life’s toughest moments. Here’s what most people miss. A power of attorney in California can remain active even if you lose capacity, but if it’s not set up right, your family could lose control over medical and financial decisions when it matters most. This means the difference between having your wishes respected or facing court battles no one saw coming.

Table of Contents

- Understanding Power Of Attorney For California Families

- Key Roles And Decisions When Appointing Power Of Attorney

- Protecting Children, Assets, And Legacy With The Right Plan

- Common Mistakes To Avoid And Best Practices In 2025

Quick Summary

| Takeaway | Explanation |

|---|---|

| Understand Types of Power of Attorney | California recognizes Financial and Healthcare Power of Attorney, each serving distinct purposes for managing financial and medical decisions when individuals are unable to act for themselves. |

| Select the Right Agent Carefully | Choosing a trustworthy agent with financial competence, emotional maturity, and strong communication skills is critical, as they will manage vital decisions on your behalf. |

| Regularly Update Documents | It’s essential to review and update power of attorney documents after major life events and periodically reassess agent capabilities to ensure compliance and relevance. |

| Utilize Professional Guidance | Working with experienced estate planning attorneys can help families navigate complexities and create tailored power of attorney documents that reflect their wishes and values. |

Understanding Power of Attorney for California Families

A power of attorney represents a critical legal mechanism that allows California families to protect their financial and personal interests during unexpected life circumstances. This legal document empowers trusted individuals to make critical decisions on behalf of someone who cannot act for themselves, providing a safety net that ensures continuous management of personal and financial affairs.

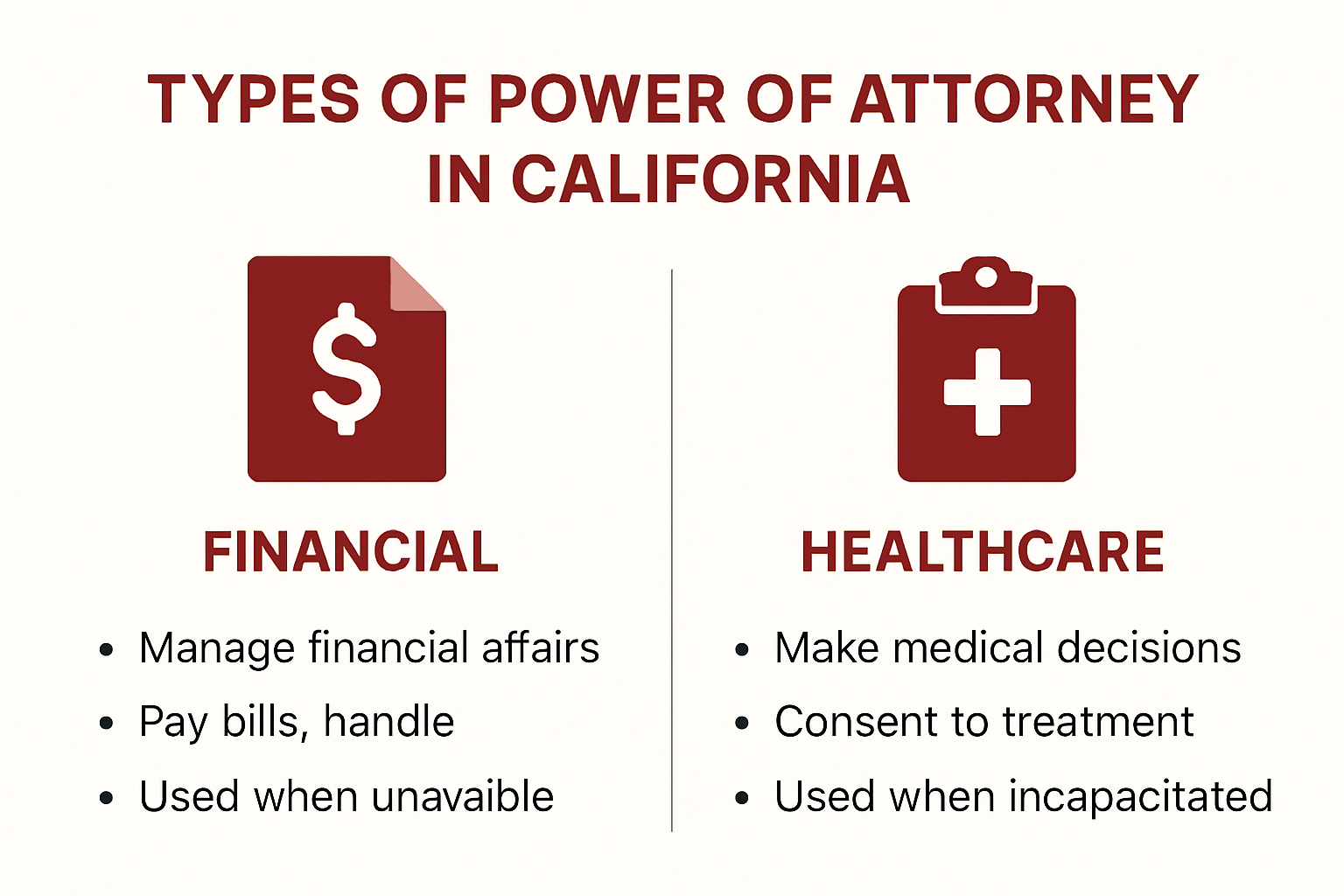

Types of Power of Attorney in California

California recognizes several distinct types of power of attorney, each designed to address specific family needs and scenarios. According to the Santa Clara County Courts, these legal instruments provide families with flexible options for managing personal and financial responsibilities.

Financial Power of Attorney: This authorization allows an appointed agent to manage financial transactions, including banking, investments, property sales, and tax filings. Families often use this when a member becomes temporarily or permanently unable to handle their own financial affairs due to illness, disability, or extended travel.

Healthcare Power of Attorney: A critical document that enables an appointed representative to make medical decisions when an individual cannot communicate their wishes. This includes choices about medical treatments, hospital care, and end-of-life decisions. California law requires specific legal requirements to ensure these documents are valid and enforceable.

Here is a comparison table summarizing the two main types of power of attorney recognized in California to help clarify their distinct purposes and authorities:

| Type of Power of Attorney | What It Covers | Typical Uses |

|---|---|---|

| Financial Power of Attorney | Banking, investments, property, taxes, financial matters | Managing finances when incapacitated or away |

| Healthcare Power of Attorney | Medical decisions, healthcare providers, end-of-life choices | Authorizing medical treatment, hospital care |

Legal Requirements and Considerations

Creating a valid power of attorney in California involves more than simply signing a document. Research from Santa Clara Courts highlights critical legal requirements that families must understand:

- The document must be signed by the principal (the person granting authority)

- It requires either notarization or witnessed by two adult witnesses who are not the designated agent

- A durable power of attorney remains effective even if the principal becomes incapacitated, providing continuous protection

Families should carefully consider their agent selection, choosing someone trustworthy, responsible, and capable of making difficult decisions. The agent becomes a legal representative with significant responsibilities, potentially managing complex financial or medical choices during challenging times.

Understanding the nuances of power of attorney is crucial for comprehensive estate planning. By proactively establishing these legal instruments, California families can ensure their wishes are respected and their loved ones are protected during unexpected life transitions.

While the process might seem complex, working with experienced legal professionals can help families navigate these important decisions, creating customized power of attorney documents that provide peace of mind and legal protection.

Key Roles and Decisions When Appointing Power of Attorney

Appointing a power of attorney is a profound responsibility that requires careful consideration and strategic planning. The selection of an agent involves more than simply choosing a trusted family member or friend. It demands a comprehensive understanding of the legal implications and potential long term consequences for both the principal and the designated representative.

Selecting the Right Agent

Choosing an agent represents one of the most critical decisions in establishing a power of attorney. California legal standards emphasize that the selected individual must demonstrate exceptional qualities of trustworthiness, financial acumen, and emotional stability. The agent will be responsible for making potentially life-altering decisions about finances, healthcare, and personal welfare.

Key attributes to consider when selecting an agent include:

- Financial Competence: The ability to manage complex financial transactions

- Emotional Maturity: Capacity to make objective decisions under stress

- Personal Integrity: Commitment to acting in the principal’s best interests

- Communication Skills: Ability to interact effectively with financial institutions, healthcare providers, and family members

Below is a summary table outlining the key qualities and attributes families should prioritize when selecting a power of attorney agent:

| Agent Attribute | Why It’s Important |

|---|---|

| Financial Competence | Manages financial matters accurately and responsibly |

| Emotional Maturity | Handles stressful decisions objectively |

| Personal Integrity | Acts solely in principal’s best interest |

| Communication Skills | Coordinates effectively with institutions and family |

Legal Responsibilities and Limitations

Agents under a power of attorney carry significant legal responsibilities. According to California law, agents must maintain meticulous records of all transactions conducted on behalf of the principal. Justia Legal Resources specifically notes that agents are required to provide a comprehensive accounting of their actions upon request by the principal, a conservator, or the principal’s legal successor.

Crucial legal limitations include:

- Agents cannot create or modify the principal’s will

- They can only establish or alter a trust if explicitly authorized in the POA document

- They must act within the specific scope of authority granted in the power of attorney document

Protecting Your Interests

To ensure comprehensive protection, families should consider multiple safeguards when establishing power of attorney provisions. This includes creating clear, detailed documentation that outlines specific powers, implementing checks and balances, and regularly reviewing and updating the document to reflect changing life circumstances.

Professional legal guidance becomes invaluable in navigating these complex decisions. Experienced estate planning attorneys can help families develop robust power of attorney documents that provide maximum protection while respecting the principal’s wishes and maintaining family harmony.

Ultimately, appointing a power of attorney is about creating a safety net that ensures your personal and financial interests remain protected, even when you cannot advocate for yourself. The right preparation and careful selection can provide peace of mind for both the principal and their loved ones.

Protecting Children, Assets, and Legacy with the Right Plan

For California families, comprehensive estate planning goes far beyond simple document preparation. It represents a strategic approach to securing future financial stability, protecting vulnerable family members, and ensuring a lasting legacy that reflects your deepest values and intentions.

Guardianship and Child Protection

One of the most critical aspects of estate planning involves protecting minor children. California lawyers emphasize the importance of proactively nominating guardians who can provide emotional and financial care if parents become incapacitated or pass away. This legal designation prevents potential court interventions and ensures children are cared for by individuals you trust.

Key considerations for guardian selection include:

- Emotional Compatibility: Shared values and parenting philosophies

- Financial Stability: Ability to support children’s basic and educational needs

- Existing Relationship: Strong pre-existing bond with your children

- Age and Health: Capacity to provide long-term care and support

Asset Protection Strategies

Protecting family assets requires a multifaceted approach that goes beyond traditional estate planning. California’s Office of the Attorney General recommends implementing comprehensive strategies that shield assets from potential legal challenges, tax implications, and unexpected financial disruptions.

Effective asset protection strategies include:

- Establishing revocable living trusts

- Creating strategic inheritance structures

- Implementing tax-efficient wealth transfer mechanisms

- Developing comprehensive insurance coverage

Legacy Planning Beyond Financial Assets

True legacy planning transcends monetary value. Our comprehensive estate planning guide highlights the importance of documenting personal values, life lessons, and familial wisdom alongside financial provisions.

Consider documenting:

- Personal ethical principles

- Family history and cultural traditions

- Educational and career aspirations for children

- Philanthropic goals and community involvement

Navigating these complex decisions requires professional guidance. Experienced estate planning attorneys can help families develop nuanced strategies that protect children, preserve assets, and create a meaningful, lasting legacy.

By taking a proactive, comprehensive approach to estate planning, California families can provide their loved ones with security, stability, and a clear roadmap for future success. The right plan does more than distribute assets it creates a lasting framework of protection, opportunity, and familial continuity.

Common Mistakes to Avoid and Best Practices in 2025

Navigating power of attorney decisions requires strategic planning and a deep understanding of potential pitfalls. As legal landscapes evolve, California families must stay informed about the most current best practices to protect their interests and ensure their wishes are accurately represented.

Critical Selection Errors to Avoid

Choosing an agent for power of attorney extends far beyond selecting a trusted family member. Estate planning experts warn that failing to clearly define an agent’s authority can lead to significant misunderstandings and potential legal disputes.

Common selection mistakes include:

- Emotional Bias: Selecting an agent based solely on familial relationship

- Lack of Financial Literacy: Choosing someone without appropriate financial management skills

- Inadequate Communication: Not discussing expectations and responsibilities with the potential agent

- Overlooking Backup Options: Failing to name alternate agents in case the primary agent becomes unavailable

The table below outlines common agent selection mistakes and their potential negative consequences, helping families identify and avoid these pitfalls:

| Mistake | Potential Consequence |

|---|---|

| Emotional Bias | Decisions based on emotion, not on best interests |

| Lack of Financial Literacy | Mismanagement of finances or improper recordkeeping |

| Inadequate Communication | Confusion and conflict among family and professionals |

| Overlooking Backup Options | No authority if the primary agent is unavailable |

Updating and Maintaining Your Power of Attorney

Static legal documents quickly become obsolete. Legal professionals emphasize the critical importance of regularly reviewing and updating power of attorney documents to reflect changing life circumstances.

Key maintenance considerations:

- Review documents after major life events (marriage, divorce, birth of children)

- Reassess agent capabilities every 2-3 years

- Ensure document remains compliant with current California legal standards

- Verify agent’s continued willingness and ability to serve

Technology and Legal Considerations in 2025

Modern power of attorney documents must account for technological advances and emerging legal complexities. Our comprehensive estate planning guide highlights the importance of creating flexible, forward-thinking legal instruments that can adapt to rapidly changing financial and technological landscapes.

Emerging best practices include:

- Incorporating digital asset management provisions

- Establishing clear protocols for cryptocurrency and digital financial assets

- Creating comprehensive communication guidelines for agents

- Implementing robust privacy and security protections

Navigating these complex legal considerations requires professional guidance. Experienced estate planning attorneys can help families develop nuanced, comprehensive power of attorney documents that provide maximum protection and flexibility.

The most effective power of attorney strategies go beyond mere legal compliance. They create a holistic framework that respects individual autonomy, provides clear guidance, and ensures family members can make informed decisions during challenging times. By avoiding common mistakes and embracing modern best practices, California families can create robust legal protections that truly reflect their values and intentions.

Frequently Asked Questions

What types of Power of Attorney are recognized in California?

California recognizes two main types of Power of Attorney: Financial Power of Attorney, which allows an agent to manage financial matters, and Healthcare Power of Attorney, which authorizes an agent to make medical decisions on behalf of someone unable to do so.

How do I select the right agent for Power of Attorney in California?

When selecting an agent, consider their trustworthiness, financial competence, emotional maturity, and communication skills. The agent should be someone who can make critical decisions in your best interest.

What are the legal requirements for a Power of Attorney in California?

To create a valid Power of Attorney in California, it must be signed by the principal, either notarized or witnessed by two non-agent adults, and it should specify whether it is durable, allowing it to remain effective if the principal becomes incapacitated.

How often should I update my Power of Attorney documents?

It is recommended to review and update your Power of Attorney documents after major life events such as marriage, divorce, or the birth of children, and to reassess the agent’s capabilities every 2-3 years to ensure relevance and compliance with current laws.

Secure Your Family’s Future With Trusted California Power of Attorney Guidance

Are you worried about the uncertainty of who will make key decisions for you or your loved ones if you cannot? As discussed in our guide, setting up a power of attorney is the only way to ensure your wishes are protected and avoid costly court involvement. Many California families do not realize how quickly problems can arise when documents are outdated or improperly prepared. Proper planning now means fewer headaches and less risk for your family in the future. Get peace of mind that your financial stability, health care choices, and legacy are all secured by experts who focus exclusively on estate protection.

Our team at the Law Office of Eric Ridley | Power of Attorney helps families craft custom, up-to-date power of attorney documents trusted by courts and financial institutions. Do not leave these important decisions to chance. See how our focused estate planning approach can give you clarity and confidence by starting with a confidential consultation at https://ridleylawoffices.com. Protect what matters most while there is still time.

Recommended

- Understanding Power of Attorney – Law Office of Eric Ridley

- The Power of Attorney in Estate Planning: Securing Your Financial and Healthcare Decisions with the Law Office of Eric Ridley – Law Office of Eric Ridley

- The Role of a Power of Attorney in Estate Planning – Law Office of Eric Ridley

- The Impact of California Laws on Estate Planning – Law Office of Eric Ridley

- Essential Estate Planning Documents Checklist for California Families 2025 – Law Office of Eric Ridley

- Essential Estate Planning Documents Checklist for California Families 2025 – Law Office of Eric Ridley