PARENTS & HOMEOWNERS: MY 7-STEP ESTATE PLANNING PROCESS WILL PROTECT YOUR HEIRS

From Creditors, Predators & Bad Choices, And Will Help You Become a (Bigger) Hero to Your Family!

Understanding Probate Costs and Fees: Essential Insights

{

“@type”: “Article”,

“author”: {

“url”: “https://ridleylawoffices.com”,

“name”: “Ridleylawoffices”,

“@type”: “Organization”

},

“@context”: “https://schema.org”,

“headline”: “Understanding Probate Costs and Fees: Essential Insights”,

“language”: “en”,

“publisher”: {

“url”: “https://ridleylawoffices.com”,

“name”: “Ridleylawoffices”,

“@type”: “Organization”

},

“description”: “Explore probate costs and fees in California, ensuring your family’s wealth is protected and comprehensively understood.”,

“datePublished”: “2025-10-02T01:40:53.508Z”

}

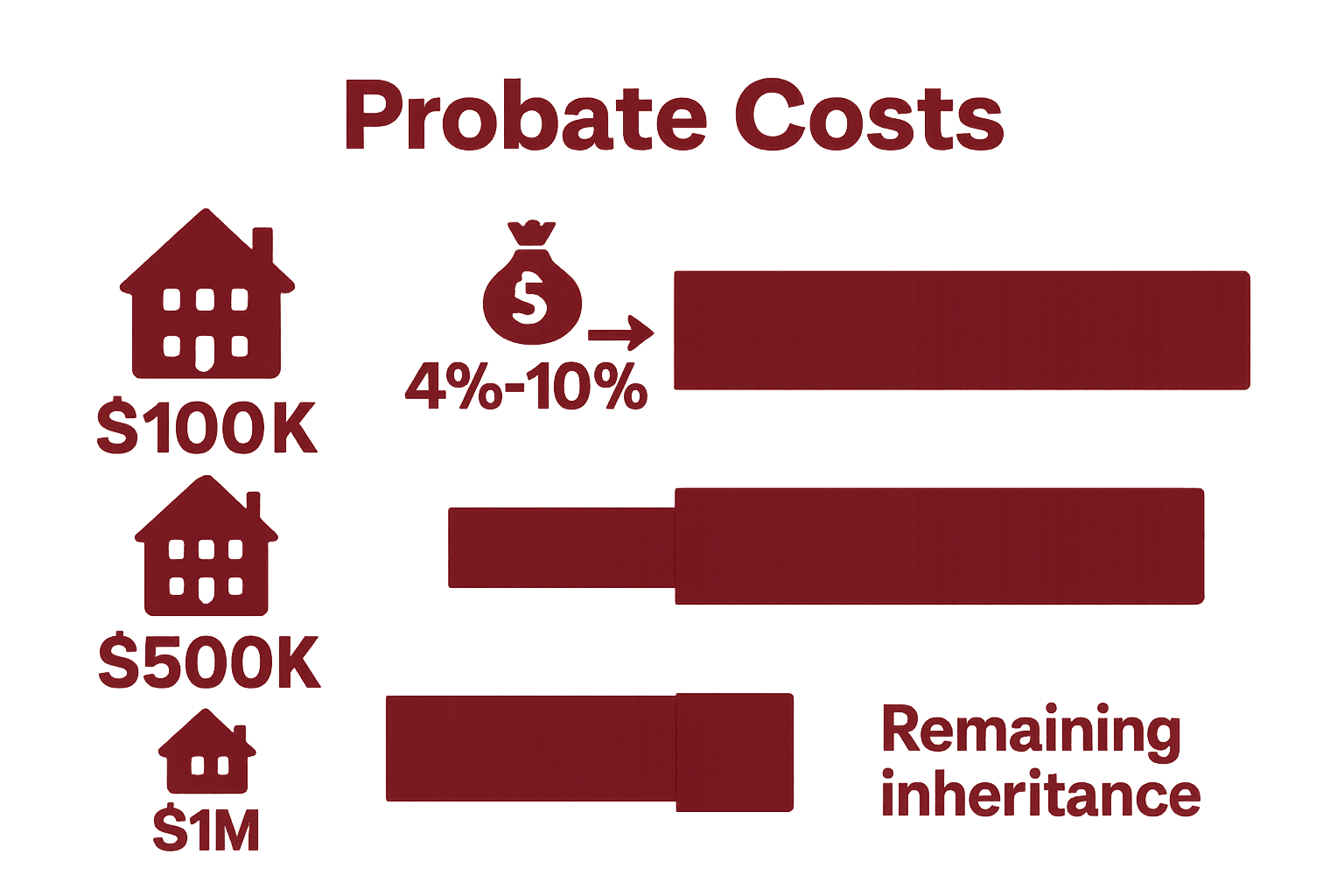

Probate costs in California can quietly drain the value of an estate before families even see a dime. Most people expect a simple transfer of assets after a loved one passes, but the reality can be far more complicated and expensive than anyone imagines. These fees often eat up 4% to 10% of an estate’s total value, which can mean $40,000 to $100,000 gone from a million-dollar inheritance and that is only part of the story. The true impact stretches far beyond numbers, reshaping financial futures and even family dynamics in ways few anticipate.

Table of Contents

- What Are Probate Costs And Fees?

- Why Probate Costs Matter For Your Estate Planning

- How Probate Fees Are Calculated In California

- Understanding The Impact Of Probate On Your Family

- Navigating Alternatives To Minimize Probate Costs

Quick Summary

| Takeaway | Explanation |

|---|---|

| Understand probate costs to protect assets | Probate fees can reduce the estate’s total value and inheritance for beneficiaries, making it essential to understand. |

| Plan to minimize probate expenses | Proactive estate planning, like establishing living trusts, can significantly reduce associated costs and preserve wealth. |

| Know the fee calculation structure | In California, probate fees are based on a percentage of the estate’s gross value, impacting overall expenses significantly. |

| Consider alternatives to probate | Utilizing joint ownership and beneficiary designations helps avoid probate and achieve quicker asset distribution. |

| Recognize emotional impacts of probate | The probate process can lead to family strain and delayed financial support, highlighting the importance of efficient estate planning. |

What Are Probate Costs and Fees?

Probate costs and fees represent the financial expenses associated with legally transferring assets after someone’s death through the court system. These expenses can significantly impact the value of an estate and the inheritance received by beneficiaries. Understanding probate costs in California requires a comprehensive examination of multiple financial components.

Breaking Down Probate Expenses

Probate costs typically encompass several key financial elements that can quickly accumulate during the estate settlement process. The primary expenses include:

- Court filing fees

- Attorney’s legal fees

- Executor compensation

- Asset appraisal charges

- Property valuation expenses

- Creditor notification costs

According to California court documentation, these fees are legally mandated and must be paid from the estate’s assets before any inheritance distribution occurs. The total expense often ranges between 4% to 7% of the estate’s total value, which can represent a substantial financial burden for families.

The following table provides a clear breakdown of the typical probate expenses in California and what each cost covers, helping you understand where estate funds are allocated during the probate process.

| Expense Category | Description |

|---|---|

| Court Filing Fees | Mandatory charges to submit legal documents and open probate |

| Attorney’s Legal Fees | Statutory or negotiated fees for estate administration guidance |

| Executor Compensation | Payment to the appointed person managing estate distribution |

| Asset Appraisal Fees | Costs to determine fair market value of estate assets |

| Property Valuation | Fees specifically related to valuing real estate or high-value items |

| Creditor Notification | Expenses for legally notifying creditors about the probate process |

Factors Influencing Probate Costs

The complexity and size of an estate significantly impact the overall probate expenses. Larger estates with multiple properties, complex investment portfolios, or potential legal disputes tend to generate higher costs. Key factors that influence probate expenses include:

- Total estate value

- Number of beneficiaries

- Potential legal challenges

- Geographic location of assets

- Complexity of asset distribution

Estate executors and family members should anticipate these expenses and plan accordingly to minimize financial strain during an already challenging time. Proactive estate planning can help reduce or potentially eliminate many of these mandatory probate costs.

Why Probate Costs Matter for Your Estate Planning

Probate costs are far more than just a financial transaction – they represent a critical factor that can dramatically impact your family’s financial legacy and inheritance potential. Understanding these costs is essential for effective estate planning and preserving the wealth you’ve worked hard to accumulate.

Financial Impact on Inheritance

Probate expenses can significantly erode the total value of an estate, reducing the amount ultimately passed to beneficiaries. Understanding the average cost for will and estate planning reveals that families can potentially lose substantial assets through probate fees. These costs are not just theoretical – they represent real money that could otherwise be transferred to your loved ones.

According to research from the American Bar Association, probate costs can consume between 4% to 10% of an estate’s total value. For larger estates, this percentage translates into significant financial loss.

Consider a $1 million estate where probate might cost $40,000 to $100,000 – funds that would otherwise be inherited by your family.

Consider a $1 million estate where probate might cost $40,000 to $100,000 – funds that would otherwise be inherited by your family.

Strategic Considerations in Estate Planning

Effective estate planning goes beyond simply drafting a will. It requires a comprehensive strategy to minimize probate costs and protect your family’s financial interests. Key strategic considerations include:

- Establishing living trusts

- Utilizing joint ownership arrangements

- Implementing beneficiary designations

- Creating gifting strategies

- Exploring alternative asset transfer methods

These approaches can help reduce or potentially eliminate probate expenses, ensuring more of your hard-earned wealth passes directly to your intended beneficiaries. The goal is not just wealth transfer, but wealth preservation through intelligent, proactive planning.

By understanding and strategically addressing probate costs, families can protect their financial legacy, minimize unnecessary expenses, and provide a more secure financial future for their loved ones.

How Probate Fees Are Calculated in California

Probate fees in California follow a structured statutory framework that determines how much attorneys and executors can charge during the estate settlement process. Explore our comprehensive guide to the California probate process to understand the nuanced fee calculation methods that impact estate administration.

Statutory Fee Structure

California law establishes a clear percentage-based system for calculating probate fees. According to California Probate Code, fees are determined by the gross value of the estate, not the net value after debts. This means the fee calculation includes the total value of assets before any outstanding obligations are subtracted.

The standard fee structure breaks down as follows:

- 4% of the first $100,000 of the estate’s value

- 3% of the next $100,000

- 2% of the next $800,000

- 1% of the next $9 million

- 0.5% of the next $15 million

Complex Fee Calculations in Practice

For a practical example, consider an estate valued at $500,000. The fee calculation would work like this:

- First $100,000: $4,000 (4%)

- Next $100,000: $3,000 (3%)

- Remaining $300,000: $6,000 (2%)

This means the total statutory fee would be approximately $13,000, which is split between the attorney and the executor.

This table outlines the standard statutory fee structure used in California to calculate attorney and executor fees during probate, offering clear visibility into how estate value affects costs.

| Estate Value Segment | Percentage Applied | Fee Amount (for segment) |

|---|---|---|

| First $100,000 | 4% | $4,000 |

| Next $100,000 | 3% | $3,000 |

| Next $800,000 | 2% | Up to $16,000 |

| Next $9 million | 1% | Up to $90,000 |

| Next $15 million | 0.5% | Up to $75,000 |

Important note: These fees are mandatory and applied before any asset distribution to beneficiaries.

Additional factors can further complicate fee calculations, including extraordinary services, real estate sales, tax issues, and potential litigation. Estate executors and attorneys must carefully document these additional services, which may require court approval for compensation beyond the standard statutory rates.

Understanding the Impact of Probate on Your Family

Probate is not just a legal process – it’s a deeply personal journey that can profoundly affect your family’s emotional and financial well-being. Learn more about how probate works in California to understand the comprehensive implications beyond mere financial transactions.

Emotional and Financial Strain

The probate process can create significant stress for families already dealing with the loss of a loved one. Beyond the financial costs, probate introduces additional layers of complexity that can strain family relationships and emotional resilience. According to psychological research on grief and inheritance, the prolonged legal process can exacerbate existing family tensions and create new conflicts.

Key emotional challenges during probate include:

- Prolonged grief processing

- Increased family conflicts

- Uncertainty about asset distribution

- Potential feelings of financial vulnerability

- Stress from complex legal proceedings

Long-Term Family Implications

Probate can have lasting consequences that extend far beyond the immediate legal proceedings. The process can potentially deplete family resources, create rifts between siblings, and delay critical financial support for dependents. Inheritance delays can be particularly devastating for families relying on these assets for immediate financial stability.

The financial impact goes beyond direct probate fees. Families may experience:

- Delayed access to critical inheritance funds

- Potential loss of time-sensitive investment opportunities

- Increased legal and administrative expenses

- Potential property value depreciation

- Emotional toll of prolonged legal processes

By understanding these potential impacts, families can take proactive steps to minimize probate’s disruptive effects and protect both their financial and emotional well-being during challenging times.

Navigating Alternatives to Minimize Probate Costs

Reducing probate costs requires strategic planning and proactive estate management. Discover smart probate alternatives for California families to protect your assets and minimize unnecessary legal expenses.

Living Trusts: A Strategic Solution

Living trusts represent one of the most powerful tools for avoiding probate and preserving family wealth. By transferring asset ownership to a trust during your lifetime, you can effectively bypass the probate process. According to California estate planning guidelines, living trusts offer several critical advantages:

- Immediate asset transfer upon death

- Privacy protection

- Reduced legal complications

- Potential tax advantages

- Flexibility in asset management

Alternative Asset Transfer Strategies

Multiple legal mechanisms exist to help families minimize probate involvement and associated costs. Effective estate planning goes beyond traditional will preparation. Families can leverage several strategic approaches:

- Joint property ownership

- Payable-on-death bank accounts

- Transfer-on-death investment accounts

- Beneficiary designations

- Gifting strategies during one’s lifetime

Each strategy offers unique benefits and potential tax implications. Comprehensive estate planning requires carefully evaluating individual family circumstances, asset composition, and long-term financial goals. Professional legal guidance can help navigate these complex decisions and develop a tailored approach that minimizes probate costs while protecting family interests.

Take Control of Probate Costs With Trusted Legal Guidance

Are you feeling overwhelmed by the uncertainty and expense of probate costs discussed in this article? Families often experience financial stress, delays, and unnecessary conflict when navigating probate on their own. The Law Offices of Eric Ridley fully understands the emotional and financial strain that court-mandated probate fees bring, especially when you just want to secure your family’s future and avoid eroding your estate.

Explore our dedicated Probate solutions for clear strategies to protect your assets right now.

You do not have to watch your loved ones face costly court proceedings or see your family’s inheritance reduced by statutory fees. Our team at The Law Offices of Eric Ridley helps California families minimize probate fees and create strong estate plans. Visit our Estate Planning resource center to learn how you can act today. Take the first step toward peace of mind and keep more of your legacy where it belongs.

Frequently Asked Questions

What are probate costs and fees?

Probate costs and fees are the expenses associated with legally transferring assets after someone’s death through the court system. These expenses can include court filing fees, attorney’s fees, executor compensation, and asset appraisal costs, potentially exhausting 4% to 10% of the estate’s total value.

How are probate fees calculated?

Probate fees are calculated based on a statutory framework that takes a percentage of the gross value of the estate. For example, in California, the fee structure typically includes 4% of the first $100,000, 3% of the next $100,000, and lower percentages on larger amounts.

What factors influence the cost of probate?

The cost of probate can be influenced by various factors including the total value of the estate, the number of beneficiaries, potential legal disputes, and the complexity of the asset distribution process. Larger estates or those with complications typically incur higher costs.

How can I minimize probate costs?

To minimize probate costs, consider strategies such as establishing living trusts, utilizing joint ownership arrangements, and implementing beneficiary designations. Planning these elements in advance can help avoid certain probate expenses and ensure a more efficient transfer of assets.

Recommended

- Probate Court Fees in California: What Successful Families Need to Know (2025) – Law Office of Eric Ridley

- Probate Costs in California: What Families Need to Know in 2025 – Law Office of Eric Ridley

- Probate Court Fees 2025: What California Families Must Know – Law Office of Eric Ridley

- Understanding Probate Process in California: 2025 Guide for Families and Homeowners – Law Office of Eric Ridley