PARENTS & HOMEOWNERS: MY 7-STEP ESTATE PLANNING PROCESS WILL PROTECT YOUR HEIRS

From Creditors, Predators & Bad Choices, And Will Help You Become a (Bigger) Hero to Your Family!

California Estate Planning Basics 2025: Protecting Family Wealth

{

“@type”: “Article”,

“author”: {

“url”: “https://ridleylawoffices.com”,

“name”: “Ridley Law Offices”,

“@type”: “Organization”

},

“@context”: “https://schema.org”,

“headline”: “California Estate Planning Basics 2025: Protecting Family Wealth”,

“publisher”: {

“url”: “https://ridleylawoffices.com”,

“name”: “Ridley Law Offices”,

“@type”: “Organization”

},

“inLanguage”: “en”,

“articleBody”: “Discover California estate planning basics for 2025. Learn simple, proven steps to protect your assets and your children’s future in California.”,

“description”: “Discover California estate planning basics for 2025. Learn simple, proven steps to protect your assets and your children’s future in California.”,

“datePublished”: “2025-07-09T00:58:17.792Z”,

“mainEntityOfPage”: {

“@id”: “https://ridleylawoffices.com/california-estate-planning-basics-2025”,

“@type”: “WebPage”

}

}

Estate planning in California is often overlooked, even though nearly 44 percent of American adults have no estate planning documents at all. That number is striking, especially when you consider the immense value tied up in California homes and family assets. Here is the twist: most families put themselves at risk of losing control over who inherits their wealth and who cares for their children, not because of bad luck, but simply by doing nothing.

Table of Contents

- Why Every California Family Needs A Modern Estate Plan

- Key Estate Planning Tools For California Homeowners

- Protecting Children And Wealth From Common Pitfalls

- How To Keep Your Estate Plan Up To Date

Quick Summary

| Takeaway | Explanation |

|---|---|

| Every California family needs a modern estate plan | Estate planning is essential for ensuring that family wealth is protected and distributed according to personal wishes, emphasizing the importance of having legal documents in place to avoid state intestate succession laws. |

| Utilize key estate planning tools | Implementing tools such as revocable living trusts, Transfer on Death deeds, and durable powers of attorney can significantly enhance financial protection, streamline asset transfer, and provide control over your estate during incapacity. |

| Regularly review and update your estate plan | Major life events like marriage, divorce, or the birth of children trigger the need for estate plan revisions, showcasing the importance of keeping documents current to avoid unintended consequences. |

Why Every California Family Needs a Modern Estate Plan

Protecting your family’s future isn’t just about accumulating wealth—it’s about ensuring that wealth survives and supports your loved ones when you can no longer do so personally. In California, where complex legal landscapes and high property values create unique challenges, a modern estate plan is not a luxury but a critical necessity.

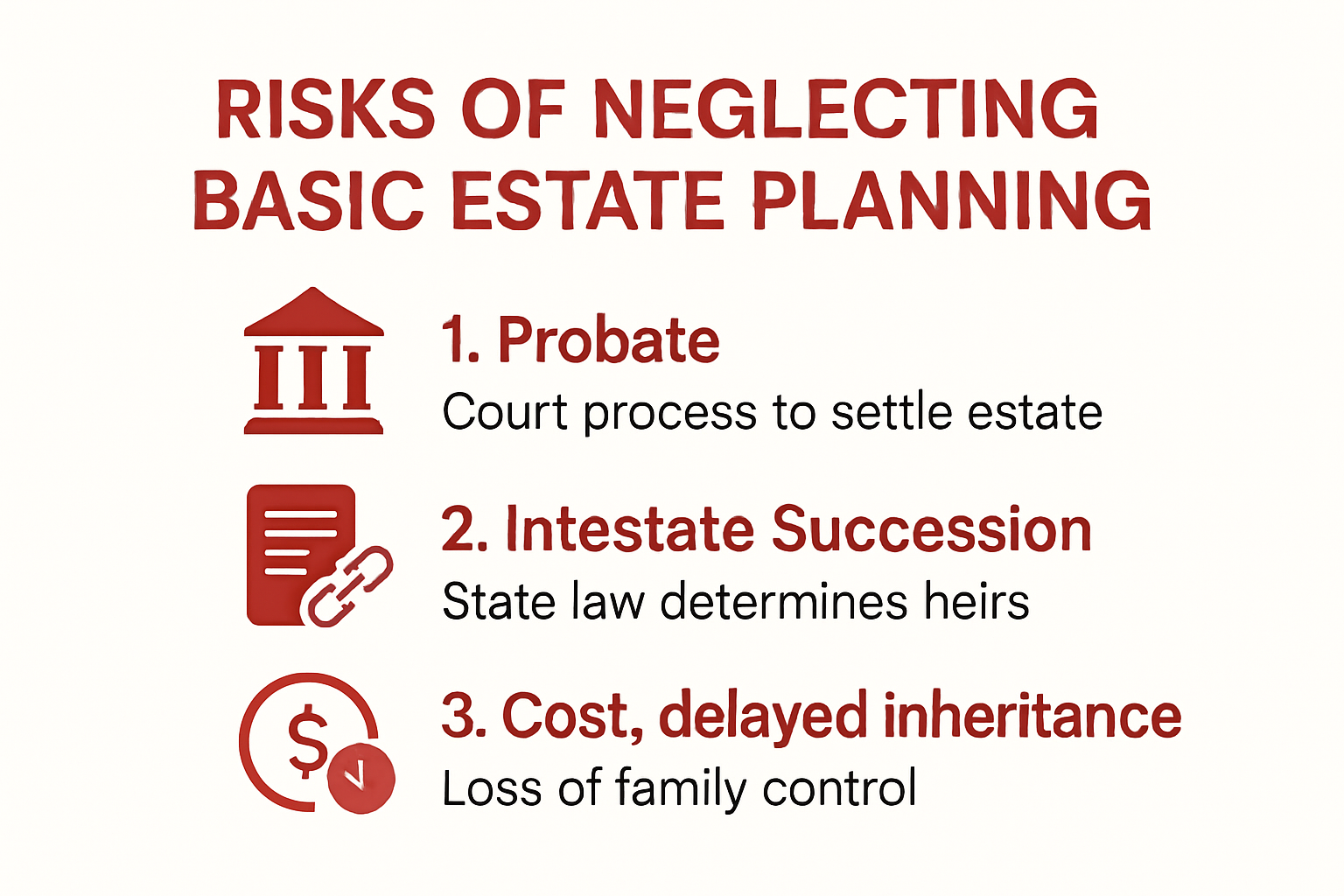

The Hidden Risks of Neglecting Estate Planning

Most California families dramatically underestimate the potential consequences of inadequate estate planning. Learn more about California estate planning strategies, particularly how state-specific regulations can impact asset distribution. According to research from UC Davis Law Review, nearly 44% of American adults have no estate planning documents, leaving their family’s financial future entirely to chance.

Without a comprehensive estate plan, California families face significant risks. The state’s intestate succession laws will determine asset distribution, which may not align with your personal wishes. This means the government essentially writes your family’s financial script if you don’t take proactive steps. Imagine a scenario where your hard-earned assets are divided according to default legal protocols instead of your specific intentions for your children, spouse, or charitable causes.

Protecting More Than Just Financial Assets

A modern estate plan transcends simple asset transfer. It’s a holistic approach to family protection that addresses multiple critical scenarios. According to California Courts Self-Help Resource, effective estate planning covers guardianship for minor children, healthcare directives, power of attorney, and strategic tax planning.

For California families, this means creating a robust framework that anticipates potential challenges. What happens if you become incapacitated? Who makes medical decisions? How are your children’s educational funds protected? A comprehensive estate plan answers these crucial questions, providing peace of mind and legal clarity.

The Financial and Emotional Cost of Inaction

Procrastination in estate planning can lead to devastating financial and emotional consequences. The California Attorney General’s office highlights that without proper estate documents, families can face prolonged legal battles, substantial court fees, and unnecessary emotional stress. Explore our guide on protecting your family’s legacy, which details the intricate process of navigating California’s complex legal requirements.

Consider the potential scenarios: unexpected disability, sudden death, or complex family dynamics can quickly transform an unprotected estate into a legal minefield. Professional estate planning isn’t just about document preparation—it’s about creating a strategic shield that preserves your family’s financial integrity and emotional well-being.

In California’s dynamic legal environment, a modern estate plan is your family’s most important financial safety net. It’s not about preparing for the worst—it’s about ensuring the best possible outcome for those you love most.

Key Estate Planning Tools for California Homeowners

California homeowners face unique estate planning challenges that require strategic and sophisticated tools to protect their most valuable assets. Understanding and implementing the right legal instruments can mean the difference between a smooth asset transition and a complex, costly legal nightmare.

Revocable Living Trusts: Your Primary Asset Protection Strategy

A revocable living trust stands as the cornerstone of effective estate planning for California homeowners. According to the California Department of Financial Protection and Innovation, this powerful tool allows property owners to transfer asset ownership while maintaining significant control during their lifetime. Unlike a simple will, a living trust enables your estate to bypass the lengthy and expensive probate process, ensuring your family can access and manage assets more quickly.

The key advantages of a revocable living trust extend beyond simple asset transfer. It provides flexibility to modify terms as your life circumstances change, protects your privacy by keeping estate details out of public court records, and offers a seamless mechanism for managing assets if you become incapacitated. Learn more about comprehensive estate planning strategies that can safeguard your family’s financial future.

Transfer on Death Deeds: Simplifying Real Estate Inheritance

California law offers a unique estate planning tool specifically designed for homeowners: the Transfer on Death (TOD) deed. Sacramento County Law Resources highlights this instrument as a powerful method to directly transfer real estate to designated beneficiaries without going through probate. This approach provides several critical benefits for California property owners.

A TOD deed allows you to name specific inheritors who will automatically receive your property upon your death, while maintaining full ownership and control during your lifetime. This means you can sell, refinance, or modify the property as you see fit, without complicated legal restrictions. For families with straightforward inheritance plans, a TOD deed can significantly streamline the asset transfer process.

Durable Power of Attorney: Financial Protection During Incapacity

Perhaps one of the most overlooked yet crucial estate planning tools is the durable power of attorney. California financial experts emphasize its importance in protecting your financial interests if you become unable to manage your affairs. This legal document authorizes a trusted individual to make financial decisions on your behalf, covering everything from real estate transactions to banking and investment management.

Without a durable power of attorney, your family might need to pursue costly and time-consuming court proceedings to gain control of your assets during a medical emergency. By proactively establishing this document, you ensure that your financial interests remain protected and that a person you trust can make critical decisions quickly and efficiently.

For California homeowners, these estate planning tools are not just legal documents—they are strategic shields protecting your family’s financial legacy. Each instrument offers unique advantages, and the right combination can provide comprehensive protection for your most valuable assets. Understanding and implementing these tools is not just smart planning—it’s a critical responsibility to your loved ones.

To help you compare the main estate planning tools for California homeowners described above, here is a table summarizing their key features and benefits:

| Tool | Purpose | Key Benefits | When to Use |

|---|---|---|---|

| Revocable Living Trust | Transfer and manage assets during life and after death | Avoids probate, flexible, preserves privacy, manages incapacity | Valuable real estate, complex estates, privacy |

| Transfer on Death (TOD) Deed | Transfer real property directly to beneficiary | Bypasses probate, retains full control, straightforward process | Simple inheritance, single property owners |

| Durable Power of Attorney | Delegate financial decisions in incapacity | Appoints trusted agent, avoids court, covers wide range of finances | Potential incapacity, any estate size |

Protecting Children and Wealth from Common Pitfalls

Estate planning for California families goes far beyond simple asset distribution—it’s about creating a comprehensive shield that protects your children’s financial future and preserves the wealth you’ve worked hard to build. Understanding the potential pitfalls can mean the difference between a lasting legacy and unintended financial vulnerability.

Strategic Guardianship and Asset Management

Choosing the right guardian for your children is perhaps the most critical decision in estate planning. According to the California Attorney General’s Office, proper guardian designation ensures your children are cared for by individuals who align with your values and parenting philosophy. Learn more about protecting your children’s future, and understand the nuanced considerations that go beyond simple legal documentation.

A comprehensive estate plan should include detailed instructions for guardianship that cover not just physical care, but financial management. This means creating trusts that provide structured financial support, protecting inheritances from potential misuse. Wealth care experts recommend establishing specific guidelines that dictate how and when children can access inherited funds, ensuring financial resources support education, healthcare, and personal development rather than becoming an unrestricted windfall.

Protecting Inherited Assets from External Risks

Inherited wealth faces numerous potential threats that most families never anticipate. Divorce, legal judgments, and unexpected financial challenges can quickly erode carefully accumulated assets. The California Department of Financial Protection and Innovation emphasizes the importance of creating robust asset protection strategies that shield inherited wealth from external claims.

Specialized trusts can provide critical protection mechanisms. For instance, a discretionary trust gives trustees the power to make distribution decisions based on beneficiaries’ changing circumstances. This approach prevents creditors from directly accessing trust assets and provides a layer of protection that traditional inheritance methods cannot match. By implementing these strategic tools, you can ensure that your children’s inheritance remains intact, even in challenging personal or financial situations.

Life Insurance and Financial Continuity

Life insurance represents a powerful yet often misunderstood estate planning tool for California families. Wealth management experts recommend structuring life insurance policies to provide maximum protection and flexibility. This means carefully selecting beneficiaries and establishing trusts that can manage and distribute these funds responsibly.

The key is creating a comprehensive strategy that goes beyond simply naming children as direct beneficiaries. A well-structured life insurance plan can provide immediate financial support while protecting against potential mismanagement. By naming a trust as the beneficiary, you can create structured distributions that support your children’s long-term financial health, covering critical needs like education, healthcare, and personal development.

Protecting your children and wealth requires more than standard legal documents. It demands a holistic approach that anticipates potential challenges, creates flexible protection mechanisms, and ensures your family’s financial legacy remains strong across generations. In California’s complex legal landscape, proactive and strategic estate planning isn’t just recommended—it’s essential.

The following table summarizes common pitfalls California families face in estate planning and the strategies discussed in this article to address them:

| Common Pitfall | Potential Consequence | Recommended Estate Planning Strategy |

|---|---|---|

| No guardianship provisions | Court decides who cares for your children | Name guardians and financial managers in your plan |

| Direct inheritance by minors | Funds may be misused or wasted | Use trusts with age/stage-based distributions |

| No asset protection for inheritance | Divorce/creditors may seize assets | Establish discretionary or spendthrift trusts |

| Improperly structured life insurance payout | Potential mismanagement by children | Name trust as beneficiary, set terms for distribution |

| Outdated beneficiaries/executors | Assets go to unintended individuals | Regularly update beneficiaries and estate documents |

How to Keep Your Estate Plan Up to Date

An estate plan is not a one-time document to be filed away and forgotten. It’s a living, breathing strategy that requires consistent attention and periodic review to remain effective in protecting your family’s financial future. California’s complex legal landscape demands proactive management of your estate planning documents.

Triggering Events That Demand Estate Plan Review

Certain life events serve as critical signals that your estate plan needs immediate revision. Explore comprehensive guidance on estate plan updates, which can help you navigate these crucial transitions. According to California legal experts, key triggering events include marriage, divorce, birth of children or grandchildren, significant changes in financial status, and the death of a named beneficiary or executor.

Each of these events can dramatically alter the effectiveness of your existing estate plan. For instance, a divorce might necessitate removing an ex-spouse as a beneficiary, while the birth of a child could require updating guardianship provisions. Failing to make these critical updates can lead to unintended consequences that potentially undermine your original estate planning intentions.

Legal and Tax Landscape Considerations

Estate planning isn’t just about personal life changes—it’s also about adapting to evolving legal and tax environments. The California Attorney General’s Office emphasizes the importance of staying current with state and federal regulations that can impact your estate’s tax liability and distribution strategies.

Tax law modifications can significantly affect how your assets are transferred and taxed. What was an efficient estate planning strategy five years ago might now result in unnecessary tax burdens. By conducting regular reviews with a professional, you can implement strategies that minimize tax implications and maximize the value of your estate for your beneficiaries.

Recommended Review Frequency and Professional Guidance

Professional estate planning attorneys recommend a comprehensive review of your estate plan every three to five years, or immediately following major life changes. Estate planning specialists suggest creating a systematic approach to estate plan maintenance that includes annual check-ins and thorough reviews.

This doesn’t mean making sweeping changes every time, but rather conducting a methodical assessment of your current documents against your life circumstances, financial situation, and legal environment. A professional can help you identify subtle shifts that might require adjustments, ensuring your estate plan remains robust and aligned with your current goals.

Your estate plan is more than a legal document—it’s a dynamic blueprint for protecting your family’s financial future. Treating it as a static artifact is a recipe for potential complications. By staying proactive, informed, and willing to adapt, you can create an estate plan that evolves alongside your life, providing peace of mind and comprehensive protection for the people and causes you care about most.

Frequently Asked Questions

What is the importance of estate planning for California families?

Estate planning is crucial for California families to ensure that their wealth is protected and distributed according to their wishes while avoiding state intestate succession laws that may not reflect their intentions.

What are some key estate planning tools for homeowners in California?

Key estate planning tools for homeowners include revocable living trusts, Transfer on Death deeds, and durable powers of attorney. These tools help streamline asset transfer, provide financial protection, and manage affairs during incapacity.

How often should I review my estate plan?

It’s recommended to review your estate plan every three to five years, or immediately after significant life events such as marriage, divorce, or the birth of a child, to ensure it aligns with your current circumstances and wishes.

What are the risks of not having an estate plan in California?

Without an estate plan, families risk having their assets distributed according to California’s intestate succession laws, which may lead to unintended heirs receiving your wealth and potentially causing family disputes. Additionally, the lack of an estate plan can lead to prolonged legal battles and emotional stress for loved ones.

Protect Your Family’s Wealth With a California Estate Plan That Works

Reading about the risks of unprotected assets, probate headaches, and lack of control over who inherits your family’s wealth can leave any Californian uneasy. The article explains that without a modern estate plan, you are letting courts and state law make personal decisions for your loved ones. Most families want security, privacy, and to avoid leaving behind confusion or financial stress. If you are concerned about outdated or missing documents such as a living trust or power of attorney, it is time to act. For proven guidance and a tailored approach, turn to our Estate Planning solutions at the Law Office of Eric Ridley.

Creating or updating your estate plan today brings peace of mind and lasting protection. Do not wait until a crisis occurs and your family faces unnecessary legal delays or costs. Start with an experienced California team focused solely on estate planning and probate. Visit https://ridleylawoffices.com or dive deeper into Wills & Trusts to discover how you can secure your legacy and simplify the future for those you love.

Recommended

- What Documents You Need for Estate Planning in California (2025 Guide) – Law Office of Eric Ridley

- California Estate Tax Planning 2025: Protecting Your Family’s Wealth – Law Office of Eric Ridley

- Estate Planning Basics in California: Protect Your Family in 2025 – Law Office of Eric Ridley

- Real Estate in Probate: California Planning Guide for Wealthy Families 2025 – Law Office of Eric Ridley

- Essential Estate Planning Documents Checklist for California Families 2025 – Law Office of Eric Ridley

- Essential Estate Planning Documents Checklist for California Families 2025 – Law Office of Eric Ridley