PARENTS & HOMEOWNERS: MY 7-STEP ESTATE PLANNING PROCESS WILL PROTECT YOUR HEIRS

From Creditors, Predators & Bad Choices, And Will Help You Become a (Bigger) Hero to Your Family!

Estate Planning for Blended Families

Estate planning is vital for ensuring that your unique family dynamics are respected and protected when life changes occur. If you are part of a blended family, it’s important to address the potential conflicts that might arise regarding assets, inheritance, and guardianship. By creating a comprehensive plan, you can clarify roles and responsibilities, ultimately providing peace of mind for yourself and your loved ones. This guide will help you navigate the complexities of estate planning specifically tailored for blended families, ensuring your wishes are upheld and your family is cared for.

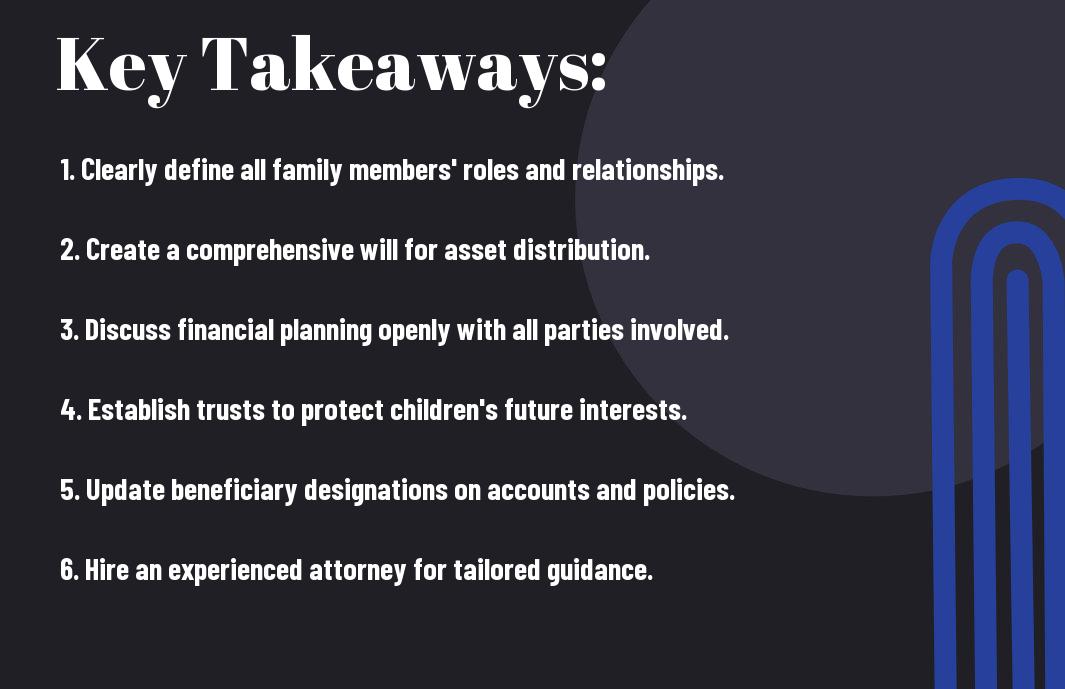

Key Takeaways:

- Open Communication: Encourage transparent discussions among all family members about estate planning to minimize misunderstandings and ensure everyone’s wishes are known.

- Document Review: Regularly review and update legal documents, such as wills and trusts, to reflect changes in family dynamics and financial situations.

- Equal Treatment: Strive for fairness by considering the needs of all children involved, whether biological or stepchildren, to promote harmony within the family.

- Professional Guidance: Seek advice from estate planning attorneys who specialize in blended family issues to address unique circumstances and legal complexities.

- Trusts and Beneficiaries: Establish trusts and be clear about beneficiary designations to protect assets and ensure they are distributed according to your intentions.

Understanding Blended Families

For anyone navigating the complexities of family dynamics, understanding blended families is vital. A blended family, also known as a stepfamily, consists of a couple who have children from previous relationships or marriages. This setup often includes step-siblings, half-siblings, and sometimes biological parents who remain involved in the children’s lives. As family structures evolve, the notion of what constitutes a family continues to change, leading to unique dynamics that can influence emotional bonds and familial interactions.

Definition of Blended Families

Definition of blended families encompasses various configurations where relationships are formed through remarriage or partnerships where one or both partners bring children into the new family unit. This means you might find yourself in a situation where you are nurturing relationships with your spouse’s children while also managing your own. The blending of different parenting styles, familial traditions, and emotional ties can be both rewarding and challenging, as each member may have their own backgrounds, loyalties, and expectations.

Unique Challenges in Estate Planning

Understanding the unique challenges in estate planning for blended families is vital to ensuring that your wishes are honored and that all family members are adequately provided for. Blended families often face complications with inheritance rights, differing financial situations, and varying relationships among family members. The complexities arise when considering the equitable distribution of assets — you must address potential conflicts between your biological children and stepchildren, ensuring fairness while also adhering to the legalities involved.

In fact, estate planning in blended families requires a clear strategy to avoid misunderstandings and disputes. With multiple parties involved, you may encounter issues such as children’s rights to inheritance, potential discontent among family members, and the necessity for transparent communication. It’s important to involve an estate planning attorney who understands these nuances to create a comprehensive plan that reflects your desires while considering the varying needs and emotional dynamics of your new family structure.

Key Considerations in Estate Planning

One of the primary challenges in estate planning for blended families is understanding how property is classified. Since different states have different laws related to property ownership, you will need to make sense of the distinctions between separate and community property. Separate property consists of assets that belong solely to one spouse, which may include inheritances and gifts received by that spouse during the marriage. Community property, on the other hand, refers to assets acquired during the marriage that are owned jointly by both spouses. It’s vital to clarify these classifications in your estate planning documents because they directly affect who inherits what after your passing.

Separate vs. Community Property

Separate property can often create confusion when it comes to estate distribution, especially in blended families where previous relationships may have established pre-existing obligations. You might find that keeping thorough and updated documentation of your separate assets is in your best interest, as this evidence can protect your wishes and assist in clarifying any potential disputes that could arise among heirs. Furthermore, understanding local laws in your state is important, as they will dictate how property division occurs upon death.

Inheritance Rights for Children

Any blended family must recognize that children’s inheritance rights can vary significantly based on family dynamics and state laws. You should ensure that your estate plan addresses the inheritance rights of both biological children and stepchildren. Many states afford equal treatment to all children unless a valid will states otherwise. This means that if you do not clearly outline your wishes, your decisions could unintentionally exclude stepchildren from what they believe they are entitled to inherit.

But as you investigate deeper into the topic, it’s important to consider that failing to properly plan for inheritance rights can lead to feelings of resentment and confusion among family members. A well-defined estate plan not only communicates your wishes but also helps maintain harmony in your blended family. This is particularly true if you have children from previous relationships; you may need to clearly articulate your intentions within your will or trust to ensure that all your heirs feel considered and valued. Furthermore, involving all parties in discussions regarding your estate can prevent misunderstandings and pave the way for smoother transitions when the time comes.

Creating a Will for Blended Families

Keep in mind that when it comes to creating a will for your blended family, clearly defining beneficiaries is crucial for avoiding potential disputes and ensuring that your wishes are honored after your passing. You need to specify not just who will inherit your assets but also the percentage or portion each beneficiary will receive. This becomes particularly important in blended families where children from previous relationships may have their own interests. By naming all intended beneficiaries explicitly, including stepchildren, you can prevent misunderstandings and foster harmony among family members.

Clearly Defining Beneficiaries

Among the most effective ways to relieve potential tension is to create a detailed list of beneficiaries in your will. This should include your biological children, stepchildren, and any other family members you believe should inherit from you. You may also want to consider naming alternate beneficiaries, as well as expressing your intentions regarding any sentimental items or family heirlooms. Clearly outlining your wishes facilitates communication about your estate and minimizes the risk of resentment or confusion among your loved ones.

Addressing Specific Bequests

One aspect of estate planning that often gets overlooked in blended families is the need to address specific bequests. In your will, you should specifically state which items or assets you want to go to particular individuals, whether they are biological children, stepchildren, or other family members. This can include personal property, real estate, or financial assets that hold sentimental value.

Families come together from different backgrounds and histories, making it crucial to outline specific bequests clearly within your estate plan. This not only helps in ensuring that cherished items are passed on to the right people but also conveys your values and intentions regarding your family’s future. By being explicit about the distribution of specific assets, you create a roadmap that can lead to a smoother transition during a period of grief and can greatly reduce the potential for familial conflict.

Trust Options for Blended Families

Revocable vs. Irrevocable Trusts

Beside understanding the difference between various types of trusts, it’s key to evaluate the implications of revocable and irrevocable trusts when planning your estate in a blended family context. A revocable trust allows you flexibility; you can alter or revoke it entirely during your lifetime. This can be beneficial for adapting your plans as family dynamics change. However, keep in mind that assets in a revocable trust are still part of your taxable estate, which could lead to implications for your heirs down the line.

On the other hand, an irrevocable trust cannot be changed once established, which means that the assets placed in the trust are removed from your estate entirely. This can serve to protect your beneficiaries from creditors and potentially reduce estate tax liabilities. However, the rigidity can be a disadvantage since you cannot modify the terms or take back the assets once transferred.

Considerations for a Family Trust

Revocable trusts offer an element of control and adaptability, but when it comes to setting up a family trust for a blended family, there are additional considerations that you should take into account. Your primary goal is to ensure fairness among all your beneficiaries, including children from previous relationships as well as children you share with your current partner. It’s important to be explicit about how the trust’s assets will be distributed after your passing, as ambiguity might lead to conflicts among heirs.

Also, consider the specific needs and circumstances of your blended family when forming a trust. This could include provisions for stepchildren and ensuring that your spouse’s needs are met without disinheriting your biological children. You may want to consult with an estate attorney who specializes in blended family dynamics to help you draft trust documents that clearly outline your wishes while addressing the unique family structure you have.

Discussing Estate Plans with Family Members

Not discussing estate plans with your family members can lead to misunderstandings and conflicts down the line. When you have a blended family, clear communication about your estate plans is necessary to prevent any feelings of favoritism or resentment. It establishes transparency and fosters an environment where everyone understands their roles, potential inheritances, and the rationale behind your decisions. By initiating these conversations, you can significantly reduce the chances of disputes that may arise after your passing.

Importance of Communication

Along with preventing misunderstandings, effective communication during estate planning enables you to address any potential issues before they escalate into larger problems. By sitting down with your family members and openly discussing your estate plans, you allow room for questions and concerns, ensuring that everyone feels heard and valued. This proactive approach lessens the emotional strain on your loved ones during an already difficult time, promoting harmony within the family.

Strategies for Productive Conversations

Against the backdrop of potential disputes, it’s vital to find the right approach when discussing your estate plans with family members. Consider creating a structured agenda for these discussions, which includes all relevant topics, from asset distribution to guardianship choices. Choose a neutral and comfortable environment that encourages candid dialogue, and be open to feedback. You might also want to encourage each family member to share their thoughts and concerns, actively listening to their perspectives to foster understanding.

In fact, developing a strategy for these discussions can also include having regular check-ins with your family regarding your estate planning. This not only makes the process feel less daunting but also establishes a culture of openness. You might choose to involve a third-party mediator, such as a financial advisor or attorney, to facilitate these discussions, ensuring that all voices are heard and respected. Ultimately, your goal should be to create a legacy that reflects your values while providing for your loved ones in a way that feels fair and considerate to everyone involved.

Working with Estate Planning Professionals

Unlike traditional families, where the lines of inheritance are often clear, blended families face unique challenges that require specialized knowledge from estate planning professionals. Engaging these experts ensures your wishes are honored, and your loved ones are adequately protected. An estate planning attorney with experience in blended family situations can provide valuable guidance on how to navigate the complexities of different beneficiaries, marital assets, and child support considerations. This path helps prevent disputes among family members and reduces the potential for confusion after your passing.

Choosing the Right Lawyer or Advisor

Estate planning in a blended family context necessitates careful selection of a lawyer or advisor who understands the intricacies involved. Your goal should be to find a professional who not only has a strong background in estate planning law but also appreciates the dynamics of blended families. Look for someone who is empathetic and takes the time to listen to your goals and concerns. Asking for referrals or checking credentials can also help ensure that you are working with someone who has the relevant experience to guide you through this sensitive process.

Importance of Regular Review and Updates

About every few years or whenever significant life changes occur, you should revisit your estate plan. The dynamics within a blended family can shift as children grow, relationships evolve, or assets change. Keeping your estate plan up to date is vital to ensure that it aligns with your current situation and intentions. This proactive approach minimizes the risk of any unintended consequences that could arise from outdated documents or decisions.

Importance of a regular review lies in your ability to adapt to life’s changes. As personal circumstances evolve, you may wish to make adjustments regarding your beneficiaries or create new trusts. Not revisiting your estate plan can lead to potential conflicts among family members and might even result in loved ones unintentionally being left out of your plans. By scheduling periodic reviews with your estate planning professionals, you help safeguard your family’s future and ensure that your wishes are preserved in line with your current family dynamics.

Summing up

Ultimately, estate planning for blended families requires thoughtful consideration of your unique family dynamics and a clear understanding of your wishes. It is crucial to communicate openly with your partner and children about your plans to minimize potential conflicts and confusion down the road. By taking the time to document your intentions in legally binding documents, such as wills and trusts, you can ensure that your assets are distributed according to your wishes while also being sensitive to the needs of all family members involved.

You should also consider working with an estate planning attorney who has experience with blended family situations. They can help you navigate complex issues such as guardianship, property division, and inheritance rights, ultimately providing peace of mind for you and your loved ones. By being proactive in your estate planning, you are not only protecting your assets but also fostering harmony within your family during what can be a difficult time.

FAQ

Q: What is estate planning for blended families?

A: Estate planning for blended families involves creating a legal framework that ensures the distribution of assets and responsibilities in a way that respects the needs of both biological and step-children. This planning takes into account the unique dynamics of blended families, aiming to prevent conflicts and ensure that all parties feel secure and valued in the event of a spouse’s passing or other significant life changes.

Q: How can I ensure that my children and stepchildren are treated fairly in my estate plan?

A: To ensure fair treatment for both biological and stepchildren, you should clearly outline your wishes in your estate planning documents, such as wills or trusts. It may also be beneficial to have open discussions with all family members about your intentions. Consider establishing trusts that specifically address the needs of different family members and provide for each child’s future. Consulting with an estate planning attorney who has experience with blended families can also help tailor your plan to suit your family’s unique situation.

Q: What types of documents are imperative in estate planning for blended families?

A: Essential documents for estate planning in blended families include a will, which specifies how your assets will be distributed; trusts, which can manage how and when your assets are distributed; powers of attorney, which designate individuals to make financial or health decisions on your behalf; and health care directives, which outline your medical preferences. Each of these documents plays a role in ensuring that your wishes are honored and that all family members are considered.

Q: Are there specific tax considerations for blended families when planning an estate?

A: Yes, tax considerations can vary greatly for blended families. Factors such as inheritance taxes, estate taxes, and gift taxes can impact how assets are distributed. It’s important to consult with a tax professional or estate planning attorney who understands the implications of your family structure. They can provide guidance on how to minimize tax burdens for your heirs and ensure compliance with tax laws while structuring your estate plan effectively.

Q: How can communication help in the estate planning process for blended families?

A: Effective communication is key to reducing misunderstandings and conflicts in blended families during the estate planning process. It allows family members to express their concerns, ask questions, and understand your intentions. By fostering an open dialogue, you can address potential issues before they arise and ensure that everyone feels heard and respected. Encouraging family meetings to discuss the estate plan can create a supportive environment, helping all members to feel included in the planning process.