PARENTS & HOMEOWNERS: MY 7-STEP ESTATE PLANNING PROCESS WILL PROTECT YOUR HEIRS

From Creditors, Predators & Bad Choices, And Will Help You Become a (Bigger) Hero to Your Family!

Simple Wills vs Complex Wills for California Families 2025

{

“@type”: “Article”,

“author”: {

“url”: “https://ridleylawoffices.com”,

“name”: “Ridley Law Offices”,

“@type”: “Organization”

},

“@context”: “https://schema.org”,

“headline”: “Simple Wills vs Complex Wills for California Families 2025”,

“publisher”: {

“url”: “https://ridleylawoffices.com”,

“name”: “Ridley Law Offices”,

“@type”: “Organization”

},

“inLanguage”: “en”,

“articleBody”: “Learn the key differences between simple wills vs complex wills for California families. Discover which best protects your children, your assets, and your legacy.”,

“description”: “Learn the key differences between simple wills vs complex wills for California families. Discover which best protects your children, your assets, and your legacy.”,

“datePublished”: “2025-08-04T01:16:36.714Z”,

“mainEntityOfPage”: {

“@id”: “https://ridleylawoffices.com/simple-wills-vs-complex-wills-california-families-2025”,

“@type”: “WebPage”

}

}

Choosing between a simple will and a complex will sounds easy at first, especially for California families hoping to protect their assets and loved ones. Yet, more than $16 billion in California estate value goes through probate every single year due to unplanned or poorly planned wills. Here is the surprise. Families with even modest assets can face the same costly pitfalls as millionaires if they pick the wrong type of will. The real difference has less to do with how much you own and everything to do with how your family and property are structured.

Table of Contents

- Key Differences: Simple Wills Vs Complex Wills

- When California Families Need A Complex Will

- Protecting Children And Wealth: Real-World Scenarios

- Choosing The Right Will For Your Unique Situation

Quick Summary

| Takeaway | Explanation |

|---|---|

| Choose a simple will for straightforward estates | Simple wills are ideal for families with uncomplicated assets and clear inheritance preferences, providing basic protections without legal complexities. |

| Opt for complex wills if assets are diversified | Families with substantial or complex assets, such as multiple properties or businesses, should consider complex wills for tailored provisions and asset management. |

| Evaluate family dynamics when selecting a will | Unique family situations, such as blended families or dependents with special needs, necessitate a complex will to ensure proper asset distribution and protection. |

| Incorporate tax strategies in complex wills | Complex wills can help minimize estate taxes and avoid probate issues, making them crucial for families with significant wealth or complex financial situations. |

| Regularly update your estate plan | Periodic reviews of your will ensure alignment with life changes, making complex wills a dynamic tool that adapts to evolving family needs and circumstances. |

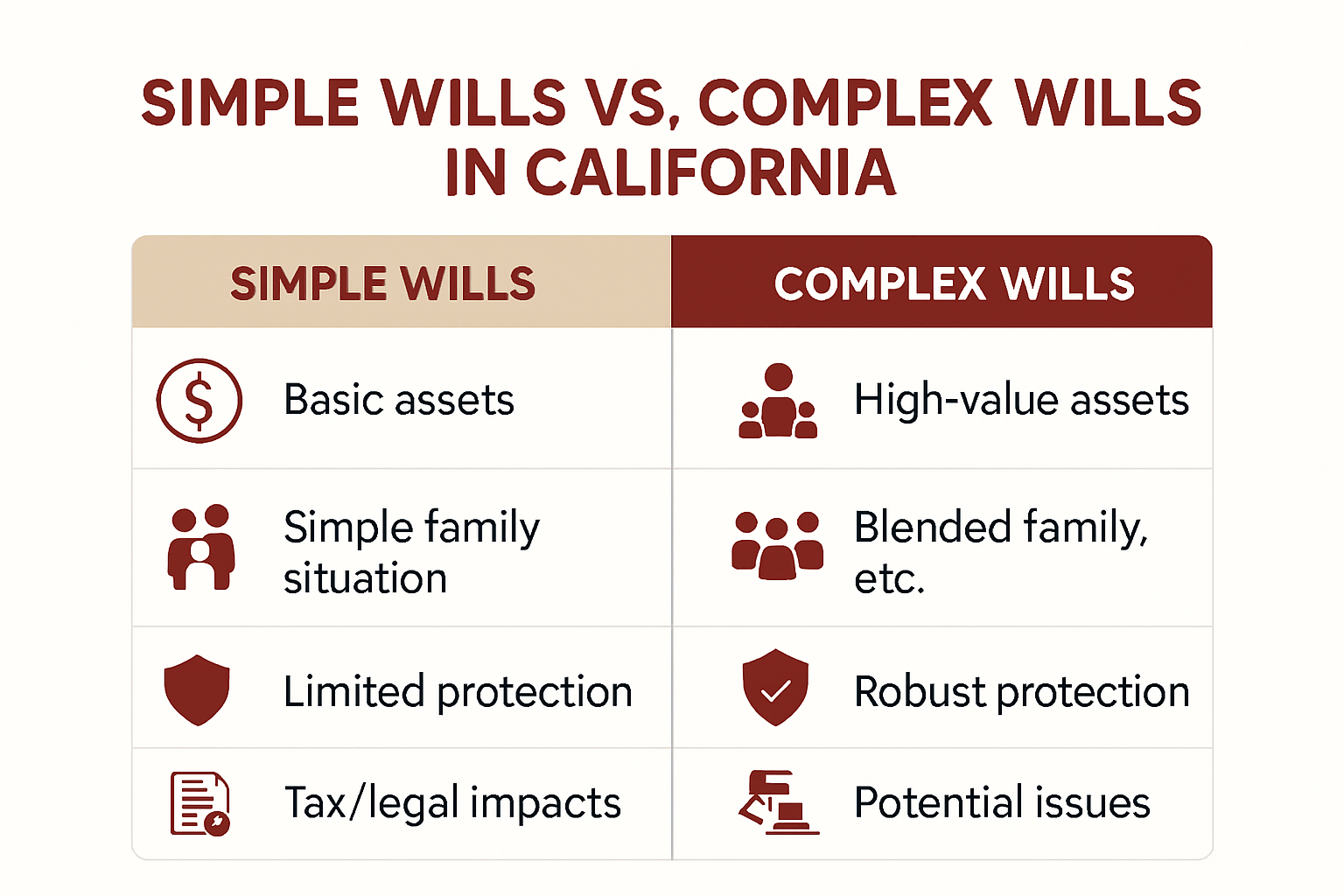

Key Differences: Simple Wills vs Complex Wills

Understanding the distinctions between simple and complex wills is crucial for California families seeking comprehensive estate planning. While both documents serve the fundamental purpose of distributing assets after death, their complexity and scope vary significantly.

Complexity of Asset Distribution

A simple will offers a straightforward approach to asset distribution. According to research from the California Bar Association, these documents typically outline basic asset transfer instructions for individuals with uncomplicated estates. They are most suitable for families with minimal assets, clear inheritance preferences, and no special circumstances requiring intricate legal arrangements.

In contrast, complex wills provide a more nuanced mechanism for asset management. Research from the Estate Planning Journal reveals that complex wills are designed for families with substantial or diversified assets, multiple properties, business interests, or unique family dynamics. These documents allow for more sophisticated provisions, such as staggered inheritances, conditional distributions, and detailed management instructions for complex asset portfolios.

Guardian and Beneficiary Protections

Simple wills primarily focus on naming an executor and potential guardians for minor children. They provide basic protections but lack the comprehensive safeguards found in complex wills. Complex wills, however, offer more robust protective mechanisms. They can establish detailed trust structures, create age-based inheritance triggers, and include specific guidelines for asset management and distribution.

For instance, a complex will might include provisions that prevent beneficiaries from accessing substantial funds until they reach certain milestones, such as completing higher education or demonstrating financial responsibility. This approach helps protect younger inheritors from potential financial mismanagement.

Tax and Legal Complexity

Simple wills generally do not address advanced tax planning strategies. They are more likely to expose estates to potential tax liabilities and probate complications. Complex wills, by contrast, can incorporate sophisticated tax mitigation techniques and legally strategic asset allocation methods.

These advanced documents can help California families minimize estate taxes, protect assets from potential legal challenges, and create more flexible inheritance structures. Experts from the California Estate Planners Association recommend complex wills for high-net-worth families or those with intricate family situations.

For families uncertain about which type of will best suits their needs, our comprehensive guide on understanding estate planning options can provide additional insights into making informed decisions about asset protection and inheritance strategies.

To clarify the distinctions between simple and complex wills, here is a comparison table highlighting their major features and protections:

| Feature / Aspect | Simple Will | Complex Will |

|---|---|---|

| Asset Distribution | Basic, straightforward instructions | Detailed, conditional, staggered or age-based provisions |

| Protections for Minors/Beneficiaries | Basic guardian/executor designations | Trusts, age/milestone triggers, additional management instructions |

| Handling of Multiple Assets | Limited, best for single property & clear heirs | Handles multiple properties, businesses, investments |

| Tax Planning | Generally limited or absent | Can incorporate tax mitigation strategies |

| Family Structure Accommodation | Best for simple (traditional) families | Blended families, special needs, potential disputes |

| Business Succession | Not generally addressed | Provisions for ownership transfer, leadership succession |

When California Families Need a Complex Will

Not every family requires a complex will, but certain circumstances demand more sophisticated estate planning strategies. Understanding when to transition from a simple will to a more comprehensive approach can protect your family’s financial future and minimize potential legal complications.

High Net Worth and Multiple Asset Categories

Families with substantial assets or diverse investment portfolios often need complex wills. According to the California Attorney General’s Office, estates exceeding $11.7 million require specialized legal strategies to mitigate significant tax implications. These families typically own multiple properties, business interests, substantial investment portfolios, and complex financial instruments that cannot be efficiently managed through standard estate distribution methods.

Complex wills allow for strategic asset allocation, enabling high-net-worth families to implement tax-efficient inheritance mechanisms. These strategies might include establishing trusts, creating conditional distributions, and developing comprehensive succession plans for family businesses.

Special Family Circumstances

Certain family dynamics necessitate more intricate estate planning. The California Courts Self-Help Guide highlights scenarios where complex wills become essential. These include families with special needs dependents, blended family structures, or situations involving potential inheritance disputes.

For instance, families with children from previous marriages might require complex wills to ensure fair asset distribution while protecting the inheritance rights of biological and stepchildren. Similarly, families with dependents requiring long-term medical care can establish special needs trusts within their complex will to guarantee continuous financial support without compromising government assistance eligibility.

Business Ownership and Succession Planning

Entrepreneurial families and business owners face unique estate planning challenges. The California Governor’s Office Master Plan emphasizes the importance of comprehensive legal frameworks for business succession. Complex wills can include detailed provisions for transferring business ownership, managing corporate assets, and protecting the company’s operational continuity.

These specialized documents allow business owners to outline precise instructions for leadership transition, define beneficiary roles, and potentially minimize tax burdens associated with business inheritance. By incorporating sophisticated legal mechanisms, families can ensure their life’s work remains protected and strategically managed across generations.

Learn more about navigating California’s complex estate planning landscape to make informed decisions that safeguard your family’s financial future and legacy.

Below is a summary table showing scenarios and assets that commonly trigger the need for a complex will in California families:

| Scenario/Asset Type | Examples | Why a Complex Will is Needed |

|---|---|---|

| High Net Worth | Estate exceeds $11.7 million | Tax mitigation, strategic asset allocation |

| Multiple Properties & Investments | Multiple homes, rental properties, portfolios | Tailored distribution, management instructions |

| Business Ownership | Family business, LLCs, partnerships | Succession planning, continuity, tax strategy |

| Special Needs Dependents | Child or adult needing medical or financial care | Special needs trusts, ongoing support |

| Blended/Non-Traditional Families | Stepchildren, multiple marriages | Protection for all heirs, dispute prevention |

| Potential Inheritance Disputes | Estranged relatives, complex relationships | Clear instructions, legal safeguards |

Protecting Children and Wealth: Real-World Scenarios

Estate planning isn’t just about legal documents. It’s about creating a comprehensive strategy that protects your family’s financial future and ensures your children’s well-being. Real-world scenarios demonstrate why complex wills and strategic planning are crucial for California families.

Blended Family Inheritance Challenges

Research from the California Family Law Journal reveals that blended families face unique inheritance complexities. Consider a scenario where a parent remarries and has children from previous marriages. A simple will might accidentally disinherit biological children or create unintended financial conflicts.

For example, imagine a successful business owner with two children from a first marriage and stepchildren from a second marriage. Without a carefully crafted complex will, the estate could be distributed inequitably. Complex wills can establish specific trusts that ensure fair asset distribution, protect the inheritance rights of biological and stepchildren, and prevent potential family disputes.

Protecting Financially Vulnerable Children

The National Institute of Family Wealth Management highlights the critical importance of structured inheritance for children with different financial capabilities. Some children might be more financially responsible than others, making uniform asset distribution potentially risky.

A complex will can implement graduated inheritance strategies. For instance, a parent could structure inheritance so that funds are released at specific life milestones. One child might receive educational trust funds, while another might have funds conditionally released based on demonstrated financial responsibility. This approach prevents potential asset mismanagement and provides long-term financial guidance.

Business Succession and Family Wealth Preservation

Family businesses represent significant financial investments that require meticulous planning. The California Business Association emphasizes that without proper estate planning, family businesses can quickly unravel after an owner’s passing.

Consider a family-owned vineyard in Napa Valley. A complex will can outline precise mechanisms for business transition, including leadership succession, ownership transfer, and potential buy-out provisions. This ensures the business remains stable and continues generating wealth for future generations. The will might establish a trust that gradually transfers business ownership, provides ongoing management guidelines, and protects the business from potential external claims.

Discover comprehensive asset protection strategies tailored for California families to secure your family’s financial legacy and provide meaningful protection for your children’s future.

Choosing the Right Will for Your Unique Situation

Selecting the appropriate will is a critical decision that requires careful consideration of your family’s specific circumstances, financial landscape, and long-term objectives. Understanding the nuanced differences between simple and complex wills can help California families make informed estate planning choices.

Assessing Your Estate’s Complexity

According to the U.S. Will Registry, estate complexity is the primary factor in determining whether a simple or complex will is appropriate. Estates under $1 million with straightforward asset distribution typically benefit from simple wills. These documents provide basic protection and clear instructions for asset transfer without extensive legal complications.

However, families with more intricate financial situations require more sophisticated approaches. Multiple properties, substantial investment portfolios, business ownership, and significant liquid assets demand the comprehensive protection offered by complex wills. These advanced documents provide greater flexibility in asset management, tax planning, and inheritance structuring.

Personal and Family Considerations

Coastline College’s Business LibreTexts emphasizes that personal family dynamics play a crucial role in will selection. Factors such as blended family structures, children with special needs, potential inheritance disputes, and unique guardian considerations significantly influence the type of will most suitable for your situation.

For families with minor children, special needs dependents, or complex family relationships, a complex will offers more robust protective mechanisms. These documents can establish detailed trust structures, create age-based inheritance distributions, and provide comprehensive guidance for asset management beyond simple asset transfer.

Future-Proofing Your Estate Plan

The California Attorney General’s Office recommends periodic estate plan review to ensure continued alignment with changing life circumstances. A will is not a static document but a dynamic tool that should evolve with your family’s needs.

Complex wills provide greater adaptability, allowing for more nuanced updates and modifications. They can include provisions for potential future scenarios, such as business succession planning, conditional inheritances, and sophisticated tax mitigation strategies. This forward-thinking approach helps protect your family’s financial future and ensures your estate plan remains relevant and effective.

Explore the comprehensive benefits of combining wills and trusts to create a robust estate planning strategy that addresses your family’s unique needs and provides long-term financial security.

Frequently Asked Questions

What is the difference between a simple will and a complex will?

A simple will provides straightforward asset distribution instructions and is best for families with uncomplicated estates, while a complex will is designed for families with substantial or diversified assets and includes detailed provisions for asset management and distribution.

When should a California family consider a complex will?

Families with substantial assets, multiple properties, unique family dynamics (such as blended families), or business ownership should consider a complex will to ensure proper estate planning and asset protection.

How can a complex will protect minor children or financially vulnerable dependents?

A complex will can establish trust structures and include age-based inheritance triggers to protect minor children and financially vulnerable dependents from potential financial mismanagement, ensuring they inherit assets responsibly.

What role does tax planning play in complex wills?

Complex wills can incorporate advanced tax strategies to minimize estate taxes and avoid probate complications, making them essential for high-net-worth families or those with complex financial situations.

Secure Your Family With The Right Will—Start With Expert Guidance

Choosing between a simple or complex will can feel overwhelming for California families. Mistakes in this decision can lead to costly probate delays, increased legal fees, and family disputes that no one wants to face. As the article highlighted, every family’s needs are different, whether you are figuring out the right protections for minor children or need advanced planning for blended families, business succession, or unique financial situations. You want peace of mind and clarity, so your assets are protected and loved ones are cared for—no matter how your estate grows or life circumstances change.

Explore our Estate Planning Resources

Let the Law Offices of Eric Ridley help you create or update your will with personalized strategies. From simple will drafting to complex trust planning, our focused experience means your estate is never left to chance. Connect with us now for a confidential, no-obligation assessment so you can protect your loved ones and avoid the risks that come with outdated estate documents. Plan confidently—your legacy deserves it.

Recommended

- Do I Need a Will in California? Protecting Your Family’s Future in 2025 – Law Office of Eric Ridley

- Key Difference Trust and Will for California Families 2025 – Law Office of Eric Ridley

- Essential Steps to Draft a Will in California for Families (2025) – Law Office of Eric Ridley

- Estate Planning Checklist 2025: Protecting California Families – Law Office of Eric Ridley