PARENTS & HOMEOWNERS: MY 7-STEP ESTATE PLANNING PROCESS WILL PROTECT YOUR HEIRS

From Creditors, Predators & Bad Choices, And Will Help You Become a (Bigger) Hero to Your Family!

Complete Guide to End-of-Life Planning in California

Roughly 67 percent of American adults lack a formal estate plan, putting their wishes and families at risk when the unexpected happens. Even a simple mistake can leave loved ones facing long court battles, unnecessary taxes, or uncertainty during already stressful times. Clear end-of-life planning does more than protect your assets. It gives your family guidance, builds peace of mind, and helps ensure your legacy passes on exactly as you intend.

Key Takeaways

| Point | Details |

|---|---|

| Comprehensive Planning | End-of-life planning extends beyond estate management, protecting personal wishes and family wellbeing during transitions. |

| Essential Legal Documents | Key documents, such as trusts and powers of attorney, empower loved ones to make important decisions when you cannot. |

| Understanding Legal Tools | Familiarize yourself with wills, trusts, and probate to ensure your assets are managed according to your wishes. |

| Avoiding Common Mistakes | Regularly update planning documents and avoid neglecting asset retitling to prevent unintended legal and tax issues. |

Table of Contents

- Defining End-of-Life Planning and Its Purpose

- Essential Legal Documents and Their Functions

- Understanding Probate, Trusts, and Wills in California

- Choosing Guardians and Protecting Minor Children

- Minimizing Taxes, Delays, and Family Conflicts

- Common Mistakes and How to Avoid Them

Defining End-of-Life Planning and Its Purpose

End-of-life planning is a comprehensive strategy that goes far beyond traditional estate management. It’s about creating a roadmap that protects your personal wishes, financial assets, and family’s wellbeing during life’s most challenging transitions. End-of-life planning encompasses legal, medical, and financial preparations that ensure your interests are preserved when you can no longer make decisions for yourself.

According to the California Attorney General’s office, advance care planning helps individuals document critical healthcare preferences through advance health care directives. These documents are powerful tools that clarify medical wishes and support families during potential health crises. The core purposes of end-of-life planning include:

- Designating trusted agents for financial and healthcare decision-making

- Ensuring medical treatments align with personal values and preferences

- Protecting assets and minimizing potential family conflicts

- Providing clear guidance for loved ones during emotionally difficult times

As research from California court resources indicates, estate planning is crucial for everyone—not just wealthy individuals. It enables you to manage lifetime issues, bypass lengthy probate processes, and guarantee that assets like your home transfer promptly to intended recipients. By proactively addressing these details, you create a safety net that provides peace of mind for both you and your family during uncertain circumstances.

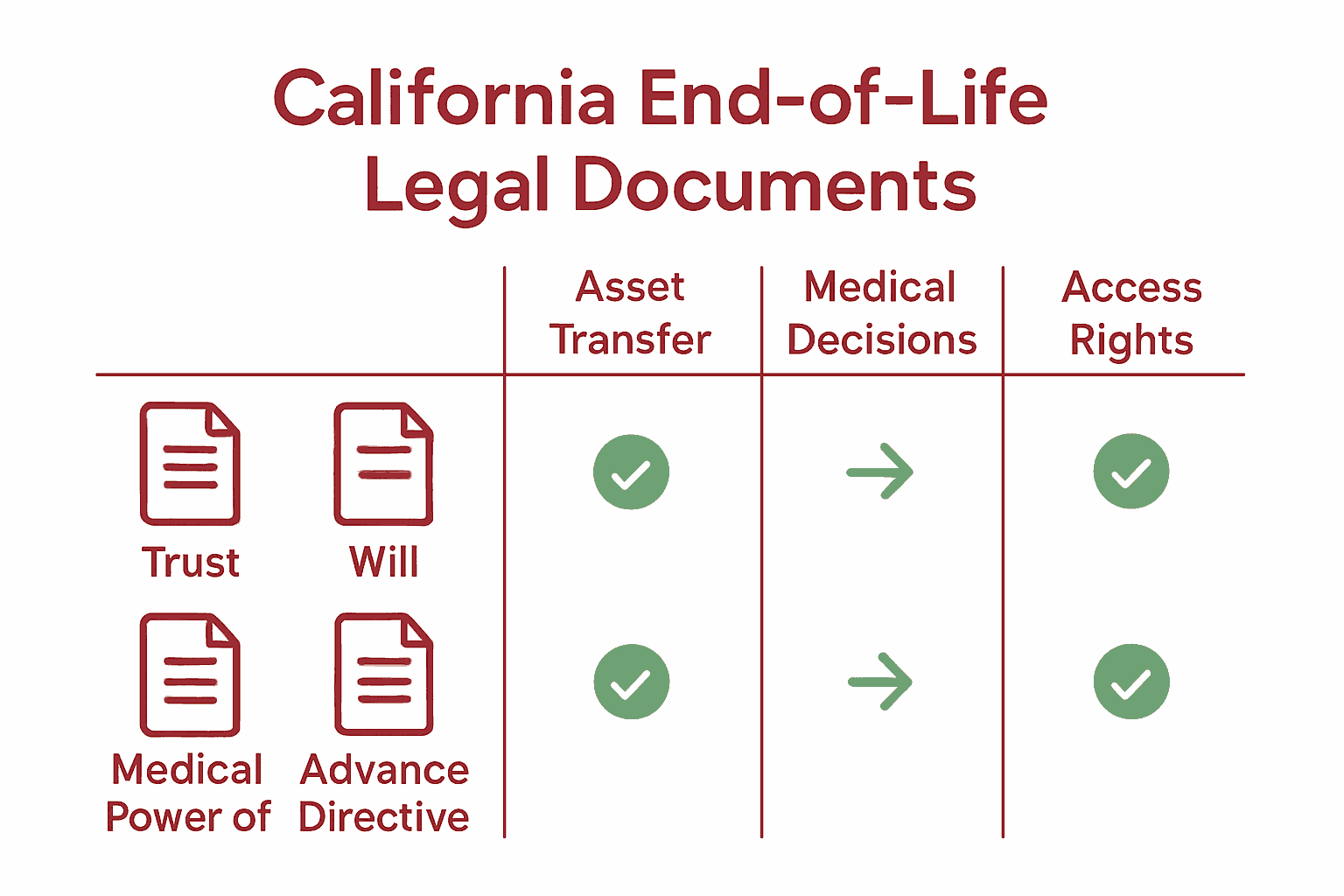

Essential Legal Documents and Their Functions

End-of-life planning requires a strategic collection of legal documents that protect your interests and empower your loved ones to make critical decisions on your behalf. These documents serve as your voice when you cannot speak for yourself, ensuring your medical, financial, and personal wishes are respected during challenging times.

According to research from legal experts, several key documents form the foundation of comprehensive end-of-life planning. Our comprehensive estate planning documents checklist highlights the most critical legal instruments:

- Revocable Living Trust: Manages your assets during incapacity and after death, providing seamless asset protection and transfer

- Medical Power of Attorney: Appoints a trusted individual to make medical decisions when you cannot

- Advance Directive/Living Will: Specifies your end-of-life medical treatment preferences

- HIPAA Authorization: Allows designated individuals to access your medical information

- Durable Financial Power of Attorney: Enables someone to manage your financial affairs if you become incapacitated

As California legal resources indicate, these documents work together to create a comprehensive safety net. A living will, for instance, specifically outlines your medical treatment preferences if you become incapacitated, while a health care proxy ensures someone you trust can make critical medical decisions on your behalf. By proactively preparing these documents, you provide clear guidance and protect your autonomy, giving your family peace of mind during potentially overwhelming circumstances.

Here’s a comparison of the essential end-of-life legal documents and their purposes:

| Document | Main Function | Who It Empowers |

|---|---|---|

| Revocable Living Trust | Asset management/protection before & after death | Trustee/Successor Trustee |

| Medical Power of Attorney | Medical decision-making if you’re incapacitated | Healthcare Agent |

| Advance Directive/Living Will | Specifies medical treatment preferences | Healthcare Providers/Agent |

| HIPAA Authorization | Access to confidential medical information | Named Individuals |

| Durable Financial Power of Attorney | Management of finances if you’re incapacitated | Financial Agent |

Understanding Probate, Trusts, and Wills in California

Navigating California’s legal landscape of estate planning requires a clear understanding of probate, trusts, and wills – three critical components that determine how your assets are managed and distributed after your death. These legal instruments are not just paperwork; they’re powerful tools that protect your family’s financial future and ensure your final wishes are honored.

A comprehensive guide to the California probate process reveals the complexity of asset distribution. According to the California Attorney General’s office, if you die without a will or trust, your assets will be distributed under intestate succession laws – which means the state decides how your property is allocated, not you.

Key differences between these legal instruments include:

- Wills: Legal documents specifying asset distribution and guardian appointments for minor children

- Trusts: More flexible instruments that can help assets bypass probate and provide more detailed control

- Probate: A court-supervised process of validating a will and distributing assets

Some assets automatically bypass probate in California, such as joint accounts, beneficiary-designated accounts, and transfer-on-death deeds. By proactively creating a comprehensive estate plan, you can maximize control over your assets, minimize potential family conflicts, and ensure your loved ones are protected according to your exact specifications.

Choosing Guardians and Protecting Minor Children

Parents face one of the most emotionally complex decisions in end-of-life planning: ensuring their children’s safety, emotional well-being, and financial security if something unexpected happens. Guardian selection is more than a legal formality—it’s about creating a comprehensive safety net that protects your children’s future when you cannot be there.

Our detailed guide to selecting the right legal guardian highlights critical considerations. According to California legal resources, wills and trusts can include explicit provisions designating care for minor children after death, empowering parents to make their intentions crystal clear in legal documents.

Key considerations when choosing a guardian include:

- Emotional compatibility and existing relationship with your children

- Financial stability of the potential guardian

- Alignment with your parenting values and beliefs

- Willingness of the individual to take on guardianship responsibilities

- Proximity to support networks and extended family

Interestingly, advance planning documents can also address temporary guardianship needs. This means you can designate someone to handle school or health decisions if you’re temporarily incapacitated. By thoughtfully creating these legal safeguards, you provide your children with continuity, stability, and a clear path forward during potentially traumatic life transitions.

Minimizing Taxes, Delays, and Family Conflicts

End-of-life planning isn’t just about distributing assets—it’s about protecting your family’s financial future and preventing potential legal battles that can tear relationships apart. Strategic estate planning serves as a powerful shield against unnecessary taxes, time-consuming legal processes, and emotional family conflicts that can arise during challenging times.

Our comprehensive guide to minimizing estate taxes reveals critical strategies for preserving your family’s wealth. According to California court resources, using a living trust can help bypass probate, which typically takes nine months or longer in the state, significantly reducing court involvement and potential disputes.

Key strategies to minimize complications include:

- Regularly updating estate planning documents

- Carefully retitling assets within trusts

- Addressing potential property tax implications

- Creating clear, unambiguous trust language

- Proactively managing potential inheritance tax scenarios

Research highlights an important caveat: even assets in a trust may be subject to probate if not properly managed. Proposition 19 and complex property-tax issues can dramatically affect inherited property, making it crucial to work with professionals who understand the nuanced legal landscape. By taking a proactive approach, you can create a robust estate plan that protects your assets, minimizes tax burdens, and preserves family harmony during emotionally challenging transitions.

Common Mistakes and How to Avoid Them

Estate planning is a delicate process where small oversights can have enormous consequences. Strategic preparation is crucial to prevent unintended outcomes that could potentially derail your entire legacy and create unnecessary stress for your loved ones. Many well-intentioned individuals make critical errors that can compromise their carefully crafted plans.

Our comprehensive guide to avoiding estate planning pitfalls reveals the most common missteps families encounter. According to legal experts, failing to properly manage estate documents can expose your assets to probate, create unexpected tax liabilities, and potentially spark family conflicts.

Critical mistakes to avoid include:

- Neglecting to retitle assets into your trust

- Failing to update beneficiary designations regularly

- Using ambiguous or vague trust language

- Forgetting to include digital asset provisions

- Not communicating your estate plan with key family members

The complexity of estate planning means that even small documentation errors can have significant consequences. A single overlooked detail or outdated beneficiary designation could potentially unravel years of careful financial planning. By working with experienced professionals and maintaining a proactive approach to updating your documents, you can create a robust estate plan that truly protects your family’s financial future and preserves your intended legacy.

Secure Your Peace of Mind with Expert Estate Planning

You have worked hard to protect your family and ensure your wishes are respected. This article highlights how failing to prepare key documents like living trusts, wills, and advance directives can lead to costly delays, probate, and even painful family disputes. The stress that comes from uncertainty or missing protections is real. You deserve a plan that is detailed, up-to-date, and designed just for California families.

Take that first step today. Connect with The Law Offices of Eric Ridley for a personalized strategy to secure your legacy, resolve complex planning questions, and give your family peace of mind. Confidence and clarity are just a conversation away. Learn more about our full range of will and trust services here and start protecting what matters most.

Frequently Asked Questions

What is end-of-life planning and why is it important?

End-of-life planning is a comprehensive strategy that includes legal, medical, and financial preparations to ensure your personal wishes and assets are protected when you can no longer make decisions for yourself. It helps clarify your medical wishes and provides guidance for loved ones during difficult times.

What essential legal documents should I prepare for end-of-life planning?

Key legal documents for end-of-life planning include a Revocable Living Trust, Medical Power of Attorney, Advance Directive/Living Will, HIPAA Authorization, and Durable Financial Power of Attorney. These documents work together to ensure your medical, financial, and personal wishes are respected.

How does probate work in California, and why does it matter in estate planning?

Probate is a court-supervised process of validating a will and distributing assets after death. If you die without a will or trust, your assets are distributed under intestate succession laws, meaning the state decides how your property is allocated, potentially leading to unexpected outcomes.

What are common mistakes to avoid in estate planning?

Common mistakes include neglecting to retitle assets into your trust, failing to update beneficiary designations, using vague trust language, and not including provisions for digital assets. These oversights can expose your estate to probate and create unexpected complications for your loved ones.

Recommended

- The Impact of California Laws on Estate Planning – Law Office of Eric Ridley

- California Estate Planning Basics 2025: Protecting Family Wealth – Law Office of Eric Ridley

- How to Update Estate Documents California: 2025 Guide – Law Office of Eric Ridley

- How to Plan for Long-Term Care in Your Estate Plan – Law Office of Eric Ridley

- Transparent Cremation Pricing Guide: Affordable Options in Perth – Best Price Cremations Perth

- Understanding Financial Planning For Seniors: A Guide | USPL – US Pro Logistics