PARENTS & HOMEOWNERS: MY 7-STEP ESTATE PLANNING PROCESS WILL PROTECT YOUR HEIRS

From Creditors, Predators & Bad Choices, And Will Help You Become a (Bigger) Hero to Your Family!

Why Make a Living Trust: Complete California Guide

Did you know probate court fees in California can eat up 4 to 7 percent of an estate’s value? Many families are shocked when expenses, delays, and public records reduce their inheritance. A living trust offers a way to sidestep these common headaches. With flexible control during your lifetime and greater privacy, understanding living trusts can help you safeguard your legacy and protect loved ones from unnecessary hassles.

Key Takeaways

| Point | Details |

|---|---|

| Living Trust Benefits | Living trusts provide asset control, avoid probate, and ensure privacy, making them a flexible estate planning tool that protects your legacy during your lifetime and beyond. |

| Types of Living Trusts | California features various living trusts, primarily revocable and irrevocable, which serve different purposes such as flexibility, asset protection, and tax advantages. |

| Trustee Responsibilities | Trustees have legal obligations to manage assets diligently and impartially, ensuring the trust operates according to the grantor’s wishes while prioritizing beneficiaries’ interests. |

| Avoiding Common Mistakes | Properly funding the trust and regularly updating it to reflect changing circumstances is crucial to prevent compromising the trust’s effectiveness in protecting assets. |

Table of Contents

- Living Trusts Defined And Key Concepts

- Types Of Living Trusts In California

- How Living Trusts Safeguard Your Estate

- Legal Rules And Trustee Responsibilities

- Living Trusts Vs. Wills And Probate Costs

- Common Mistakes To Avoid With Trusts

Living Trusts Defined and Key Concepts

A living trust is a sophisticated legal financial planning tool that allows you to manage and protect your assets during your lifetime and beyond. According to research from Santa Clara County Courts, this powerful estate planning instrument goes into effect immediately and provides remarkable flexibility for asset management.

At its core, a living trust enables you to:- Retain complete control over your assets while alive- Designate a successor trustee to manage assets if you become incapacitated- Avoid lengthy and expensive probate court proceedings- Preserve your family’s financial privacy

As Kiplinger’s research explains, the trust acts as a fiduciary mechanism where a trustee must distribute assets precisely according to the grantor’s wishes. This means you’re creating a legally binding roadmap for your assets that can adapt to changing life circumstances.

The real power of a living trust lies in its ability to provide seamless asset management. Unlike a traditional will, which only activates after your death, a living trust offers continuous protection. Whether you’re planning for potential incapacity or ensuring your children’s financial security, a living trust gives you unprecedented control over your financial legacy. Read more about the strategic benefits of trusts to understand how this tool can transform your estate planning approach.

Types of Living Trusts in California

California offers a diverse range of living trusts designed to address different financial planning and estate management needs. According to Blasser Law, these trusts can be categorized primarily into two main types: revocable and irrevocable, each serving unique purposes in comprehensive estate planning.

Key types of living trusts in California include:

Here’s a summary of the main living trust types in California:

| Trust Type | Key Features | Primary Purpose |

|---|---|---|

| Revocable Living Trust | Changeable Can be revoked anytime |

Flexibility and control |

| Irrevocable Living Trust | Permanent Cannot be changed after signing |

Asset protection Tax benefits |

| A/B (Bypass) Trust | For married couples Splits into two trusts |

Maximize estate tax savings |

| Special Needs Trust | Extra protections Government benefit safe |

Support loved ones with disabilities |

- Revocable Living Trusts: Flexible trusts that can be modified or completely revoked during the trustor’s lifetime

- Irrevocable Living Trusts: Permanent structures that cannot be altered once established

- A/B (Bypass) Trusts: Specialized instruments for married couples to maximize estate tax benefits

- Special Needs Trusts: Designed to provide financial support for family members with disabilities without jeopardizing government benefits

As Bay Legal highlights, California residents have access to additional sophisticated trust options such as:

- Life Insurance Trusts

- Qualified Personal Residence Trusts

- Spendthrift Trusts

- Charitable Trusts

- Generation-Skipping Trusts

- Blind Trusts for confidential asset management

Choosing the right type of living trust depends on your specific financial goals, family dynamics, and long-term estate planning objectives. Learn more about selecting the most appropriate trust for your situation, as each trust type offers unique advantages tailored to different personal and financial circumstances.

How Living Trusts Safeguard Your Estate

A living trust serves as a powerful shield for your estate, offering comprehensive protection that goes far beyond traditional estate planning methods. According to Orange County Courts, these legal instruments provide critical safeguards that protect your assets and ensure your financial wishes are honored precisely.

Key estate protection mechanisms include:

- Avoiding lengthy and expensive probate proceedings

- Preventing court-mandated conservatorship during incapacity

- Maintaining complete financial privacy

- Enabling rapid, direct asset transfer to beneficiaries

- Protecting assets from potential legal challenges

As Kiplinger’s research explains, living trusts allow grantors to retain control of their assets while alive while simultaneously creating a robust mechanism for seamless asset management. This means your estate remains protected and flexible, adapting to changing life circumstances without subjecting your family to complex legal proceedings.

The ultimate power of a living trust lies in its ability to provide continuous, personalized protection. Whether you’re planning for potential future incapacity or ensuring your children’s financial security, discover how a living trust can transform your estate protection strategy. Your assets deserve more than a simple will—they deserve comprehensive, adaptive protection.

Legal Rules and Trustee Responsibilities

Trustees in California bear significant legal responsibilities that go far beyond simple asset management. According to Goff Legal, these appointed individuals are fiduciaries with strict legal obligations designed to protect beneficiaries’ interests and ensure the trust operates exactly as intended.

Key trustee responsibilities include:

- Acting with absolute loyalty to beneficiaries

- Maintaining complete impartiality among beneficiaries

- Following the trust document precisely

- Avoiding personal financial conflicts of interest

- Managing assets under the Prudent Investor Rule

- Keeping detailed, accurate financial records

- Filing necessary tax documents

- Providing regular accountings to beneficiaries

As outlined by Legal Clarity, the California Probate Code imposes serious legal consequences for trustees who breach these fundamental duties. This means trustees must manage trust assets with the same level of care and diligence they would apply to their own financial affairs, always prioritizing the beneficiaries’ best interests.

Choosing the right trustee is critical. These responsibilities require financial acumen, legal understanding, and personal integrity. Learn how to select a trustee who can navigate these complex responsibilities, ensuring your estate remains protected and your wishes are faithfully executed.

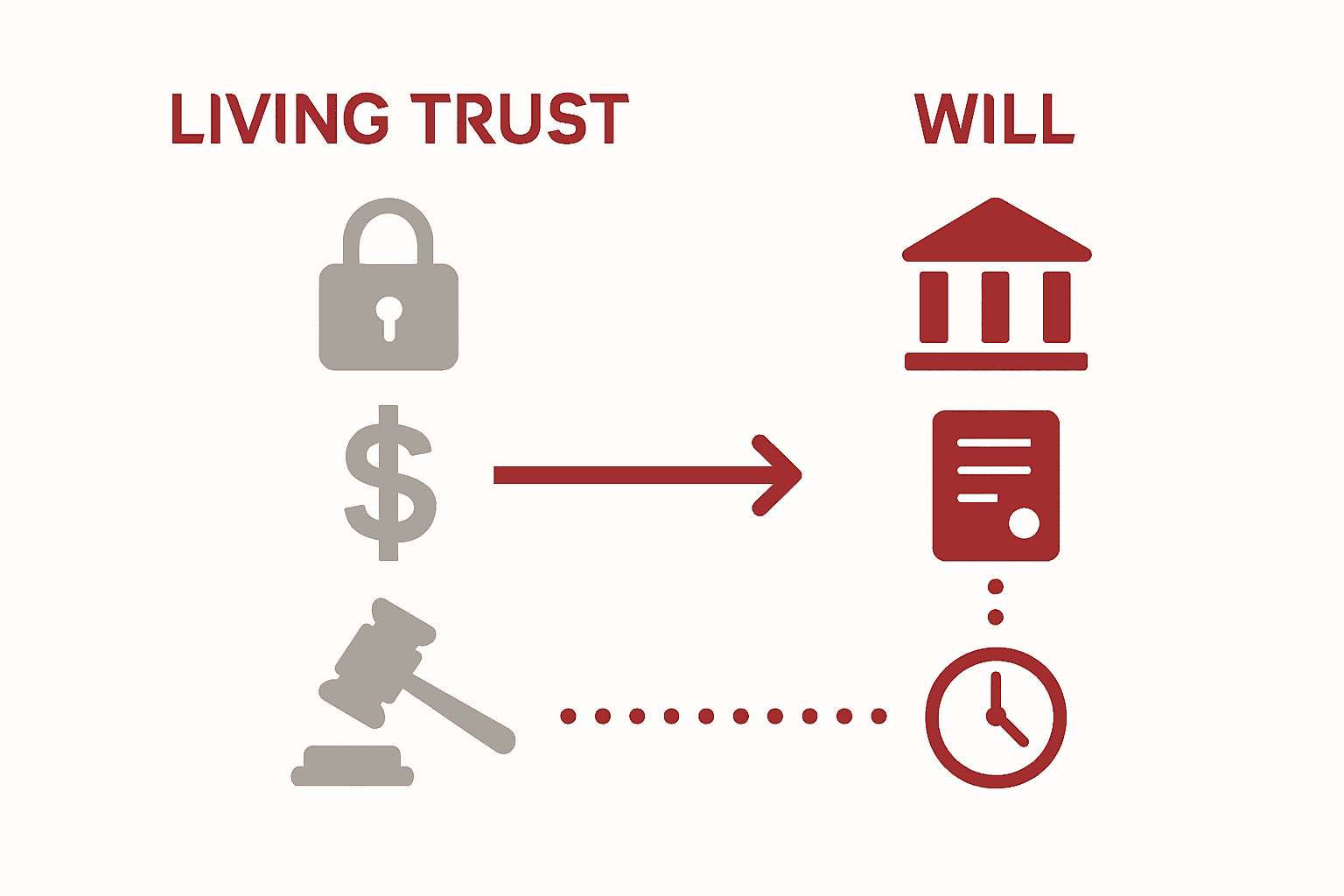

Living Trusts vs. Wills and Probate Costs

In California, the difference between living trusts and traditional wills can significantly impact your estate’s financial future. According to SmartAsset, wills must go through probate—a public, time-consuming, and often expensive legal process that can substantially reduce your estate’s value.

Key differences between wills and living trusts include:

- Probate Process: Wills require court supervision; trusts avoid probate entirely

- Privacy: Wills become public record; trusts remain confidential

- Cost: Probate fees can consume 4-7% of estate value; trusts minimize these expenses

- Control: Trusts offer more flexible asset distribution and management

- Incapacity Planning: Trusts provide immediate management if you become unable to handle finances

As Guideway Legal highlights, California’s probate process can be especially costly for estates exceeding $208,850. Probate fees start at 4% for the first $100,000 and scale up, potentially consuming a substantial portion of your hard-earned assets.

Living trusts offer a strategic alternative, allowing your beneficiaries to avoid these expensive legal proceedings and maintain more of their inheritance.

Learn more about the comprehensive benefits of choosing a trust over a traditional will, and discover how this powerful estate planning tool can protect your family’s financial future.

Common Mistakes to Avoid With Trusts

Creating a living trust is not a one-time event but an ongoing process that requires careful attention and periodic review. According to Ignacio Law, many families unknowingly compromise their estate plans by making critical mistakes that can unravel their carefully constructed protection.

Most common trust planning errors include:

- Failing to fund the trust by not transferring actual assets

- Keeping outdated beneficiary designations

- Selecting inappropriate or unprepared trustees

- Missing crucial tax planning opportunities

- Creating generic, one-size-fits-all document templates

- Neglecting to update the trust as life circumstances change

As Guideway Legal emphasizes, the most serious mistake is improper trust funding. Without correctly retitling assets into the trust—including real estate, bank accounts, and personal property—families may still face the very probate process they sought to avoid.

Additional risks emerge when new assets are forgotten, property titles revert after refinancing, or retirement and insurance account designations conflict with trust instructions.

Additional risks emerge when new assets are forgotten, property titles revert after refinancing, or retirement and insurance account designations conflict with trust instructions.

Learn how to avoid the pitfalls that can derail your estate planning efforts, and ensure your trust provides the comprehensive protection your family deserves.

Ready to Protect Your Legacy With a Living Trust?

If you are feeling uncertain about your family’s future or concerned about probate delays, high costs, or unwanted legal disputes, you are not alone. As explained in this guide, living trusts offer control, privacy, avoidance of probate, and reliable asset protection. The process can feel overwhelming, especially when mistakes in trust funding or trustee selection put your plans at risk. Our focus at the Law Office of Eric Ridley | Estate Planning | Wills & Trusts is helping Californians create tailored living trusts and estate strategies with confidence.

Take control today. Secure your legacy, avoid stressful probate, and give your loved ones peace of mind. Start your estate planning journey with our trusted team at https://ridleylawoffices.com. For guidance on advanced planning, wills, and trusts, explore more resources at our estate planning solutions page. Reach out now and let us help you protect what matters most.

Frequently Asked Questions

What is a living trust?

A living trust is a legal financial planning tool that allows you to manage and protect your assets during your lifetime and beyond. It provides flexibility for asset management and avoids probate.

What are the differences between a living trust and a will?

Unlike a will, which goes into probate, a living trust avoids court proceedings, maintains privacy, and offers more flexible asset distribution while providing immediate management in case of incapacity.

What are the main types of living trusts?

The primary types of living trusts are revocable trusts, which can be changed or revoked anytime, and irrevocable trusts, which cannot be altered once established. Other types include A/B trusts and special needs trusts.

Why is it important to properly fund a living trust?

Failing to fund a living trust by not transferring assets into it can result in your estate being subjected to probate, undermining the purpose of the trust and complicating asset management for your beneficiaries.

Recommended

- Steps for Trust Creation in California: Secure Your Family in 2025 – Law Office of Eric Ridley

- Revocable Living Trusts for Families in California 2025 – Law Office of Eric Ridley

- Living Trust vs Will in California: 2025 Guide for Families – Law Office of Eric Ridley

- Types of Trusts in California: Protecting Family Wealth in 2025 – Law Office of Eric Ridley

- Notarizing Wills and POA’s in Ontario will notary near me – My Mobile Notary

- 9 Steps To Your Ultimate Moving To California Checklist | USPL – US Pro Logistics