PARENTS & HOMEOWNERS: MY 7-STEP ESTATE PLANNING PROCESS WILL PROTECT YOUR HEIRS

From Creditors, Predators & Bad Choices, And Will Help You Become a (Bigger) Hero to Your Family!

Why Update Your Will in 2025: Protect Your Family and Assets

Most people think writing a will is a one-and-done task and never give it another thought. But more than 70 percent of family wealth transfers actually fail because of poor communication and outdated estate plans. The real surprise is that updating your will could be the single most important move you make in 2025 to protect your family from costly court battles, financial chaos, and the heartbreak of conflict.

Table of Contents

- Life Events That Demand A Will Update

- Protecting Children And Managing Inheritance

- Avoiding Costly Mistakes And Family Disputes

- How To Easily Update Your Will In California

Quick Summary

| Takeaway | Explanation |

|---|---|

| Update your will after major life changes | Major events like marriage, divorce, or children’s births necessitate will modifications to reflect your current wishes and protect your loved ones. |

| Ensure proper guardianship for minor children | Clearly appoint guardians in your will to prevent state laws from deciding guardianship, which may not align with your preferences. |

| Communicate your estate plan with family | Open discussions about your will can greatly reduce misunderstandings and conflicts during estate distribution among your family members. |

| Understand California’s specific legal requirements | Familiarize yourself with California’s will guidelines, such as witness requirements and community property laws, to maintain legal validity. |

| Avoid informal modifications to your will | Always create a new will or a legally recognized codicil instead of making informal changes, to ensure your estate plan remains enforceable. |

Life Events That Demand a Will Update

Life is constantly changing, and your will should reflect those transformations. Failing to update your estate plan can leave your family vulnerable and your assets exposed to unexpected legal complications. Learn how to protect your family’s future.

Marriage and Divorce Changes

Marital status shifts dramatically impact estate planning. When you get married, your existing will might become invalid or require significant modifications. According to AARP, marriage typically revokes previous wills, meaning your current document may not legally represent your current wishes. Divorce presents another critical update moment. Your will likely needs complete reconstruction to remove your former spouse as a beneficiary or executor.

Key considerations during marital transitions include:

- Beneficiary Designations: Updating who receives your assets

- Executor Selection: Choosing a new representative for your estate

- Guardian Assignments: Potentially changing guardianship for minor children

Financial Milestones and Asset Changes

Significant financial events demand immediate estate plan reassessment. Acquiring substantial assets like real estate, starting a business, or experiencing a major inheritance requires comprehensive will updates. FindLaw emphasizes that substantial wealth increases necessitate more complex estate planning strategies to minimize tax implications and protect your family’s financial future.

Financial triggers for will updates include:

- Purchasing significant property

- Launching a business

- Receiving a substantial inheritance

- Experiencing dramatic income changes

Family Expansion and Life Transitions

Having children fundamentally transforms your estate planning needs. Your will must address guardianship, financial provisions, and long-term care for your children. The Smithsonian Institution recommends reviewing your will every few years, especially after major family changes. This includes not just births, but also adoptions, marriages of children, or changes in extended family dynamics.

Critical family-related update moments involve:

- Birth or adoption of children

- Children reaching legal adulthood

- Changes in family health circumstances

- Significant shifts in family relationships

Updating your will isn’t just a legal formality—it’s a crucial step in protecting your family’s future. Each life transition presents an opportunity to ensure your estate plan accurately reflects your current circumstances and intentions. By proactively managing your will, you provide your loved ones with clarity, protection, and peace of mind during potentially challenging times.

To help you quickly identify the types of life events that require a will update and their key considerations, see the summary table below:

| Life Event Type | Examples/Triggers | Key Considerations |

|---|---|---|

| Marriage or Divorce | Getting married, divorce/separation | Update beneficiaries, executors, guardians |

| Financial Milestones/Asset Changes | Property purchase, business launch, inheritance | Asset listing, tax planning, new documents |

| Family Expansion/Transitions | Child birth, adoption, children become adults | Guardianship, new provisions, care plans |

| Change in Family Health/Status | Major illness, health decline, relationship shifts | Update caretakers, instructions, review |

Protecting Children and Managing Inheritance

Parents face complex challenges when designing an inheritance strategy that protects their children’s financial future while preventing potential mismanagement. Learn about comprehensive estate planning for parents to ensure your children’s long-term security.

Guardianship and Financial Protection

Appointment of guardians represents a critical component of protecting minor children. According to the University of Minnesota Extension, without a properly drafted will, state laws determine guardianship and asset distribution, which may not align with parental preferences. This legal uncertainty can leave children vulnerable during already challenging transitions.

Key considerations for guardianship include:

- Character Assessment: Selecting guardians who share your values

- Financial Capability: Ensuring guardians can manage potential inheritance

- Emotional Compatibility: Choosing individuals who can provide emotional support

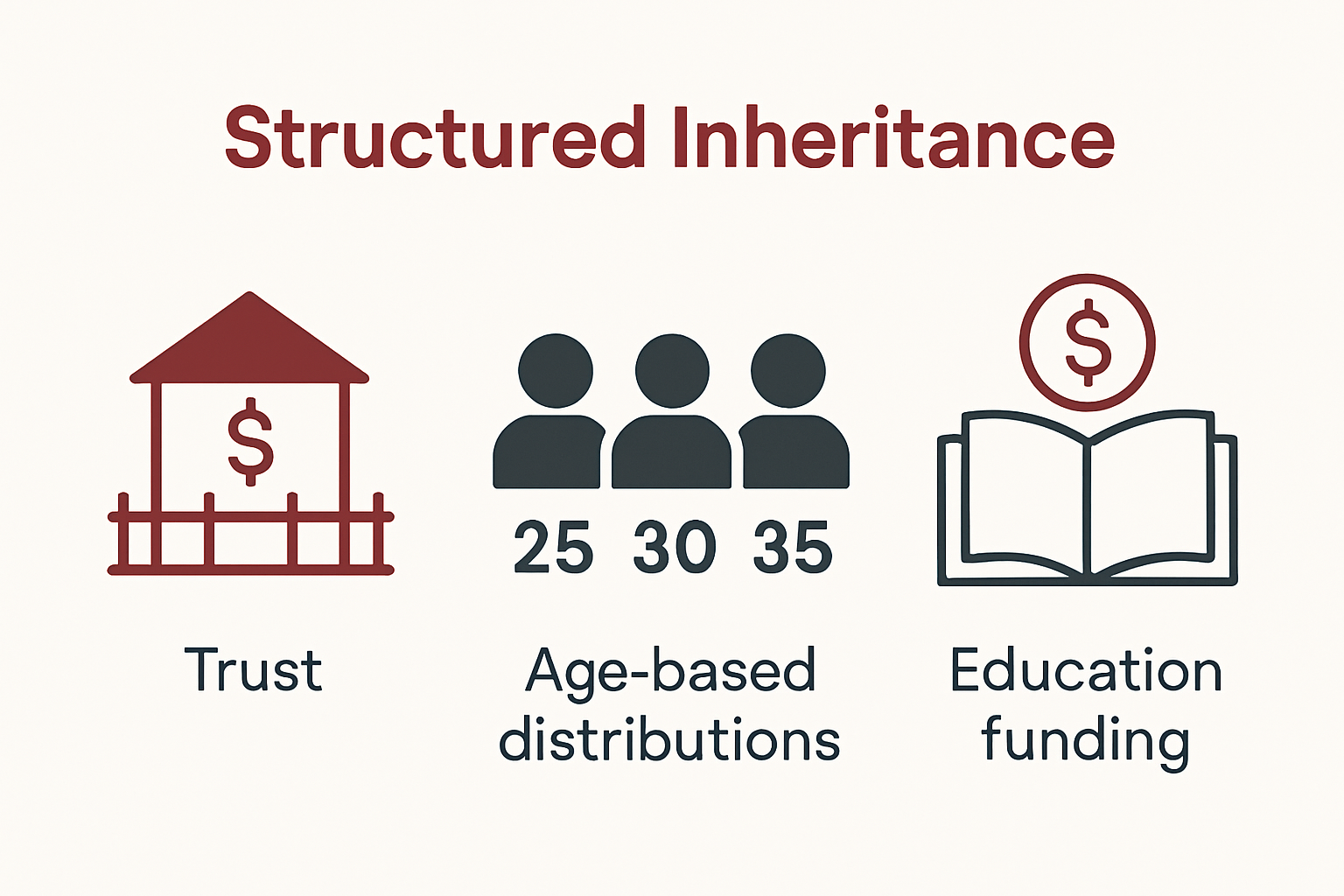

Structured Inheritance Strategies

Traditional inheritance models often fail to protect children from potential financial mismanagement. Laws & More highlights that establishing trusts within a will can control asset distribution until children reach maturity. This approach prevents sudden wealth from becoming a potential liability.

Strategic inheritance planning involves:

- Creating staged distribution mechanisms

- Establishing educational funding provisions

- Implementing age-based inheritance triggers

- Developing financial education requirements

Long-Term Financial Security

Comprehensive estate planning goes beyond immediate asset transfer. The UK government’s inheritance guidelines emphasize the importance of creating flexible frameworks that adapt to changing family dynamics. This means designing inheritance strategies that provide financial security while teaching responsible wealth management.

Effective long-term protection requires:

- Comprehensive financial education provisions

- Clear instructions for asset management

- Flexibility to address future life changes

- Mechanisms to protect against potential legal challenges

Your children’s inheritance is more than a financial transaction—it’s a legacy of support, education, and opportunity. By carefully crafting your will and inheritance strategy, you can provide a safety net that nurtures their potential while protecting them from potential financial pitfalls. Proactive planning ensures that your hard-earned assets become a bridge to their future success, not a source of potential conflict or mismanagement.

Avoiding Costly Mistakes and Family Disputes

Estate planning mistakes can fracture families and drain substantial financial resources. Learn how to prevent common estate planning errors and protect your family’s future.

Communication and Transparency

Silence is the primary catalyst for family conflicts during estate distribution. According to research from the Williams Group Wealth Consultancy, approximately 70% of family wealth transfers fail due to poor communication. Transparent discussions about your estate plan can dramatically reduce potential misunderstandings and legal disputes.

Key communication strategies include:

- Clear Expectations: Discussing inheritance details with family members

- Document Rationale: Explaining reasoning behind specific estate decisions

- Regular Updates: Keeping family informed about estate plan modifications

To clarify and compare the major sources of family estate conflict and ways to reduce them, refer to the following summary table:

| Common Cause of Conflict | Example Issue | Prevention Strategy |

|---|---|---|

| Lack of Communication | Unaware of inheritance plans | Share estate plans openly and regularly |

| Ambiguous Documentation | Vague will instructions | Use precise language and legal guidance |

| No Conflict Resolution Plan | Disputes escalate to courts | Include mediation and clear protocols |

Legal and Financial Precision

Imprecise language and incomplete documentation create significant legal vulnerabilities. The National Institute of Estate Planning reports that ambiguous will language leads to approximately 30% of probate litigation cases. Precision in legal documentation is not just recommended—it’s essential for preventing potential family conflicts.

Critical areas requiring meticulous attention include:

- Exact beneficiary designations

- Clear asset valuation and distribution instructions

- Comprehensive guardian and executor specifications

- Potential tax implications and mitigation strategies

Conflict Resolution Mechanisms

Building conflict resolution mechanisms directly into your estate plan can preemptively address potential disputes. Implementing mediation clauses and clear dispute resolution protocols can save families hundreds of thousands in potential legal expenses. The American Bar Association suggests that proactive conflict resolution strategies can reduce potential litigation by up to 60%.

Effective conflict prevention strategies involve:

- Mandatory mediation clauses

- Independent third-party executors

- Detailed explanation of inheritance decisions

- Provisions for potential family disagreements

Your estate plan is more than a legal document—it’s a blueprint for family harmony. By prioritizing clear communication, legal precision, and proactive conflict resolution, you can create an estate plan that preserves not just your financial legacy, but your family’s emotional connections. Thoughtful planning transforms potential sources of conflict into opportunities for understanding and mutual respect.

How to Easily Update Your Will in California

Navigating will updates in California requires strategic planning and understanding of specific legal requirements. Discover the latest guide to updating estate documents to ensure your legacy remains protected.

Understanding California-Specific Legal Requirements

California has unique estate planning regulations that significantly impact will updates. According to the California Courts Self-Help Guide, residents must follow specific protocols to ensure their will remains legally valid. These requirements differ from other states, making professional guidance crucial.

Key California-specific considerations include:

- Witness Requirements: California mandates two adult witnesses who are not beneficiaries

- Holographic Will Provisions: Handwritten wills have distinct legal standards

- Community Property Laws: Unique marital asset distribution rules

Practical Steps for Will Modification

Updating your will involves more than simply crossing out old text. The California Attorney General’s Office emphasizes the importance of creating a completely new document or adding a legally recognized codicil. Attempting informal modifications can invalidate your entire estate plan.

Comprehensive will update process involves:

- Drafting a completely new will

- Executing a formal codicil

- Officially revoking previous documents

- Notifying key executors and beneficiaries

- Storing updated documents securely

To simplify your next will update in California, here’s a step-by-step process table summarizing the actions described above:

| Step | Action | Purpose |

|---|---|---|

| 1 | Draft new will or formal codicil | Ensure full legal validity |

| 2 | Officially revoke prior documents | Prevent confusion or disputes |

| 3 | Sign with required witnesses | Meet California legal standards |

| 4 | Notify executors and beneficiaries | Keep stakeholders up to date |

| 5 | Securely store updated documents | Protect documents and ease future access |

Avoiding Common Update Pitfalls

Many Californians make critical errors when updating their wills. The California Lawyers Association warns that improper updates can lead to lengthy probate disputes and potential family conflicts. Professional legal guidance helps navigate these complex requirements.

Common mistakes to avoid include:

- Informal handwritten changes

- Failing to properly witness new documents

- Not officially revoking previous versions

- Overlooking recent life changes

- Neglecting to update digital asset provisions

Updating your will is not just a legal formality—it’s a critical step in protecting your family’s future. California’s complex legal landscape demands precision and professional insight. By understanding the state-specific requirements and working with experienced estate planning professionals, you can create a robust will that adapts to your changing life circumstances while providing maximum protection for your loved ones.

Frequently Asked Questions

Why is it important to update my will after major life events?

Updating your will after major life changes, such as marriage, divorce, or the birth of a child, ensures that your estate plan reflects your current wishes and protects your loved ones.

How can I ensure proper guardianship for my minor children in my will?

You can ensure proper guardianship by clearly appointing guardians in your will. This prevents state laws from deciding their guardianship without considering your preferences.

What are common mistakes to avoid when updating my will?

Common mistakes include making informal handwritten changes, failing to properly witness new documents, not officially revoking previous versions, and overlooking recent life changes.

What specific legal requirements must I follow to update my will in California?

In California, you must have at least two witnesses who are not beneficiaries, and you should either draft a new will or add a formally recognized codicil to ensure legal validity.

Secure Your Legacy and Prevent Costly Mistakes With Expert Support

Do not let outdated documents or unexpected life events leave your family vulnerable to expensive court battles, probate delays, or uncertainty. As discussed in this article, failing to update your will can result in improper guardianship choices, missed asset protection opportunities, and unwanted family conflict. If you are in California and facing transitions like marriage, divorce, growing your family, or acquiring new assets, you need tailored solutions that cover every detail.

Take the first step to peace of mind today. Visit the Law Office of Eric Ridley | Estate Planning | Wills & Trusts category to learn how our estate planning services can help you proactively secure your legacy. You can also explore Law Offices of Eric Ridley to connect with an experienced attorney who will help you avoid costly mistakes and create a will that reflects your wishes in 2025 and beyond. Book your confidential consultation now to protect what matters most.

Recommended

- Do I Need a Will in California? Protecting Your Family’s Future in 2025 – Law Office of Eric Ridley

- How to Update Estate Documents California: 2025 Guide – Law Office of Eric Ridley

- Top Reasons to Update Your Estate Plan Regularly – Law Office of Eric Ridley

- How to Update Your Estate Plan After Major Life Changes – Law Office of Eric Ridley

- How to Create a Notarized Will in Ontario (2025 Guide) – My Mobile Notary

- Estate Cleanout Tips: Quick Guide for Connecticut in 2025 – C&M Carting Solutions